I made a million bucks today, again! Yep. That is the common adage in the day trading industry, picking and choosing the best days in order to look very good in the eyes of newbies. Well guess what, we didn’t have any “classic opportunities” on May 1st and I am more than willing to admit it. I didn’t make a million bucks, I didn’t lost anything, I sat in front of the computer and wished the rain would stop. It was as boring as […]

Market Recaps

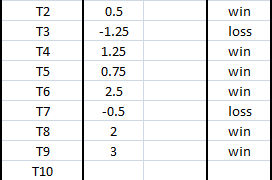

April 30th Recap: 5pts ($2500 Available)

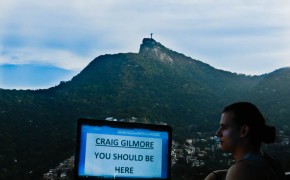

Welcome to the last day of the month! It is certainly not a nice day in Rio de Janeiro only decided to spend the entire day with hookah, reggae, and a day trading. I have taken over the living room and as you can see with the picture below this is my office for the day. No Bundas here, if you don’t know what a Bunda and see this recap. I am very excited about some of the developments that have been […]

April 27th Recap: 11.75 points in 30 minutes

It has been a while hasn’t it? We have a fantastic penthouse apartment overlooking the entire city here in Rio and we have been working diligently on what we now call the Day Trading Proyecto. That is going to be the name of the day trading center in Colombia, Brice and I (will formally introduce Brice soon) are probably a year or more away from actually having a solid plan but I am very excited about the concept. We haven’t explored much […]

April 10th Recap: 21 points – Over $10,000 Available

As I am writing this post, I just informed Brice that quote “Pascua” is spelled with u-a at the end and not a-u, Pascua is Spanish for Easter. I keep trying to remind them that were in Brazil now, not Colombia. The LTD Project Brazil has officially started. I will have you know that I actually met Brice through twitter, we had a blind date eating an entire table of sushi and it was love at first sight. Follow Brice at twitter: @BriceinColombia Follow […]

April 9th Recap: 6 pts – Over $3,000 Available

This week started off great especially since I ended the day with a view that you see above, it seems like every day I remind myself what a beautiful city Rio de Janeiro is. Do not be fold however, Rio is a beautiful city from faraway not from up close. I’m really excited about this week, not only because it’s my birthday, but I’m also officially moving into a new apartment which will be the control center from here on out in […]

A Special Request For Easter In Brazil

Its not everyday you get a specific request for a picture. But being that it was Easter I had to fulfill it, check out more about my travels on my travel blogs, WanderingTrader.com. I will be living in Brazil for the next month so catch updates specifically on my travel blog site. I will be sharing some stories here on the Day Trading Academy as well.

April 4th Recap: $4000 Available: Welcome to Brazil!

Welcome to Rio de Janeiro everyone! I have quite a bit of trouble finding an apartment here in the city and the prices are so outrageously high, but I am sitting here with a great view of the mountainside and Christ the Redeemer statue. I will be sharing more pictures of my current day trading office soon and of my new apartment that I will be moving to next Wednesday. Today was not the first day that I trade here in Brazil, […]

March 22nd Market Recap

Click here to see the complete list of Market Recaps

Emini Trading Recap: March 21st: $5,000 Available

It’s midweek and I can honestly say that it has been a fantastic week so far. I’m going to start making updates to the LTD Project in terms of what how I started, why I wanted to do this, and even how I chose the specific traders that I plan on incorporating in the program and training via the LTD Project. For those of you that do not know what the LTD Project is, I am taking a group of day traders […]

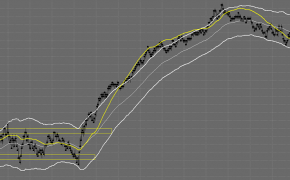

Over $6,500 Available: March 20th Recap 13+ Points

This is what I live for, you wake up and market is moving well, you don’t have to wait for any opportunities. The second you wake up and we turn on our monitors we are in and out of the market. I finished the day at 11am which is what I would like to do every day. The amount that money using the tagline above of just over $6000 is assuming 10 contracts. I want you to think about this for a […]