Today’s online trading is a very unique day in the market since the FOMC (Federal Operating Market Committee) minutes are coming out. Trading the morning during the FOMC can be a toss up.

The vast majority of the times the market will either behave itself and give us good opportunities in the early morning or it will give us nothing at all. With the volatility that the market has shown in the last few weeks I wanted to watch at least the early morning.

During this important item of news traders will behave in one of two ways:

- Focus on trading in the early morning and come back after the FOMC statement is out

- Just trade the afternoon after the market is out

Don’t ever get upset if a trade continues going without you, its a part of trading

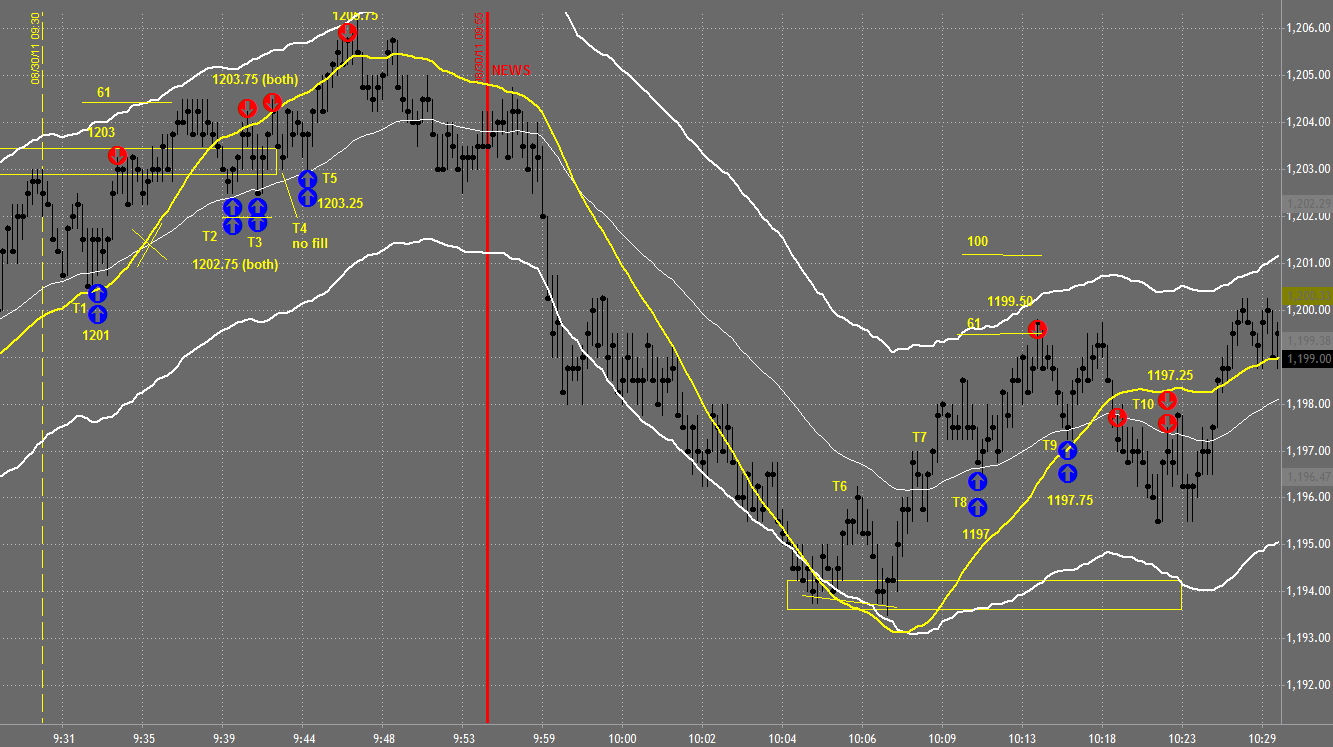

The market then came back to the midband again and it still didn’t break through the main resistance area at 1203 so I put my scalping techniques into play with T2-T5. T2 and T3 were quick 1 point trades and I managed to go pivot to pivot which I was very pleased with. I missed the fill for T4 since the market hit my price but didn’t break through it.

Once I was in T5 I decided to minimize my risk and go for the big run. At some point the market is going to either break to the upside or break back down. Notice the consolidation at 1203. There were plenty of targets at 1205 to 1206 so I decided to place my target 1206.75. Target filled.

News sent the market flying to the downside

Once I got filled I went to the Loo!

That is how they say bathroom here in Kenya. Looks like I am already getting used to living here. T9 was a great trade as well it just didn’t run to the upside. I lost two ticks on T9 after bringing up my stop.

And that brings us to the last trade of the day which was T10. Good momentum but take a look how the market began to consolidate, I lost 3 ticks on that trade. The market wasn’t making any new highs or lows, the market was simply starting to respect new support and resistance areas. Since I was up just over 8 points and Facebook was honestly more entertaining at this point I decided to call it a day.

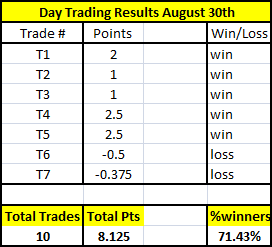

Online Trading Recap for Aug 30th

- Total of 10 trades available

- Took 7 trades

- Won 5 out of 7 trades

- Lost 2 trades

- Missed filled on two trades

- Didn’t take 1 trade for more confirm