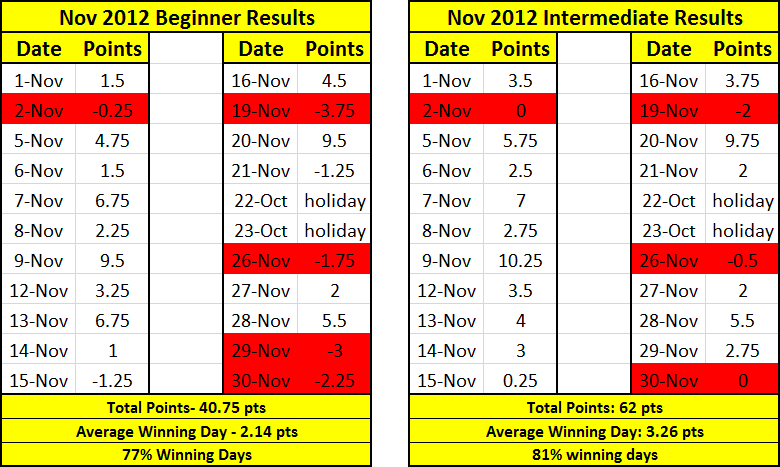

Taking a peak at the yearly results through the month of November is really all about consistency. The daily average was roughly 2 points per day and the winning average was close to 80%. I consider the winning average to be a high as the winning average in the industry should be roughly 60% to 70%.

For those of you that aren’t familiar with futures 2 pts equates to roughly $100 (1 point=$50) and it doesn’t account for the number of contracts.

For the Emini S&P 500, we are able to trade with a maximum of roughly 300 to 400 contracts before we start to get slippage (problems filling all of our contracts). With the current volume I would estimate roughly 100 to 200 contracts, don’t ask me exactly how I know this.

The idea behind day trading is not to make a billion dollars a day, its about consistency.

This is one of the reasons that all of the traders in our training program learn how to understand the market and be able to adapt to the changes. Day trading software & indicators complicate things since we aren’t able to pay attention to what is important, the market.

One of the things that every trader should understand is that they should get rid of any fancy colors and indicators in order to really be able to understand how the market works. If we are able to be consistent make a small profit everyday then eventually we can add plenty of contracts and make a living day trading.

Its almost the end of the year and the reason why I started keeping track of the beginner results was to answer the question of how much money a day trader can really make every day. The short answer is a ton of money but most day traders don’t start out making a ton of money.

We all start with one contract or one share of stock and build our accounts

I stand behind the Congressive Trading System not because I am the name behind it, I stand behind it because it stands for everything that is wrong with the day trading industry. We have been spoon fed this idea that software that magically does the thinking for us is the answer to our problems.

I compare it with the all the infomercials that promise rapid weight loss with a magic pill to take everyday. The same goes for the magical ab crunching machines that will get us amazing 6-pack abs for the summer.

If we really understood how to lose weight, eat correctly & exercise, we wouldn’t be buying any of that nonsense.

I sit in my chair in India proudly modeling an extra 30 lbs on my aging body because I am too lazy to go to the gym. Most day traders sit in their chairs complaining why they aren’t making money when they go out and keep trying to buy the magic pill and the ab machines that aren’t going to work (indicators and software).

We obviously have a day trading education program but it really isn’t about learning how to trade from us, it isn’t even about learning from anyone else.

Its about understanding what it takes to actually be a professional day trader

That is consistency and it has to do with understanding how the market works and not paying attention to colorful indicators and software.

That was my rant for the day! I often repeat that lesson over and over again because most of us are stubborn and think that we can do things our own way. If we can just just understand how the market works and make a bit of money everyday then we will eventually be able to make a living day trading.

The November beginner & intermediate results were no different and they were directly in line with the yearly averages.

One of the things that we have been extremely impressed with is how the numbers jump when we incorporate risk management. The beginner results have zero risk management which means that we don’t try to minimize our risk (try to lose less money). It also doesn’t include any reward management which is where we try to maximize our profits to make more money. Its called the HTS technique where we hold for the target or stop.

The results from the month were similar to the rest of the year and we can see a significant jump in the intermediate results when we incorporate risk management. The numbers jump considerably since the intermediate results depict a trader that has started to get used to how the market moves and be able to minimize risk in the process.

Not losing money is more important than making money

We are really excited to share the final year results and start the new year with a renewed drive. We are having to invest in the program in order to provide even more quality to the advanced traders that are already making money. Its a great problem to have in all honesty, to have so many traders that are starting to make money.

We are having to create an all new advanced & pro curriculum to ensure that they continue to learn and get better.

We just finished a full week of students running the live classes for everyone in the training program and it went exceptionally well. I’m so overloaded since I refuse to allow anyone to teach that doesn’t actually trade live. Now that we have so many students that are making money they run classes to help provide different points of view and they get better in the process.

I hope your trading year was as successful as ours and we look forward to exceeding expectations in 2013, again.

Click here to see the disclosure that the good ole boys at the CFTC require us to share with you about the results above.

Where do you hold training classes? When will you hold the next one?

Shoot us an email via our contact page on the top right Owen and we will be happy to help you with that my man