Recap from another one of our master traders day… introduction coming soon:

Runs, retracements and stops oh my….runs, retracements and stops oh my. There is that weird futures trading dream again.

Trading is completely new world. You learn a new pseudo-language, ticks, fib. extensions, annoying areas, snap-crackle-pop, strong fyl, weak bb’s, wedges, head and shoulders, con-gressive…..Your thought process changes….you think in terms of probabilities and expected outcomes. You see things differently….on charts you see opportunities where the average person only sees squiggly lines and colors.

Moreover, life in general becomes more enjoyable as trading allows you unbelievable freedoms.

It’s not just about making a living, which in and of itself is rewarding enough, but it is time and location freedom. You know all those vacations you cannot take because you do not have the time or money. Or that great city, state or country you would love to live in but can’t because of your job’s geographical hold on you?

Well that’s the kind of freedom I’m talking about. Freedom of time and location!!!!

Some may think that this is all a pipe dream, pie in the sky. Well that’s why I’m writing this blog post. To let you know that there is a better way. Is this for everyone? Probably not, but it may not be for the reasons you think. Some think they need to be mathematicians, software engineers or rocket scientists to do this……

I do have some colleagues in our trading community that are exactly those kinds of guys, but that is not what makes them successful. In fact sometimes being so highly intellectual is in most cases what hinders some from progressing sooner if not at all.

What it takes is a deep, burning desire to have the kind of life you want to have. Our founder and CEO at The Day Trading Academy reviews his life and has done just that. He lives a life that few can live. He has travelled to over 80 countries and visited all 7 continents and all because of his trading. You can follow his travel exploits on his travel blog Wanderingtrader.com.

As for me….I was given the opportunity to become a student at The Day Trading Academy and have made the best of it.

Here are my charts and results and review for today.

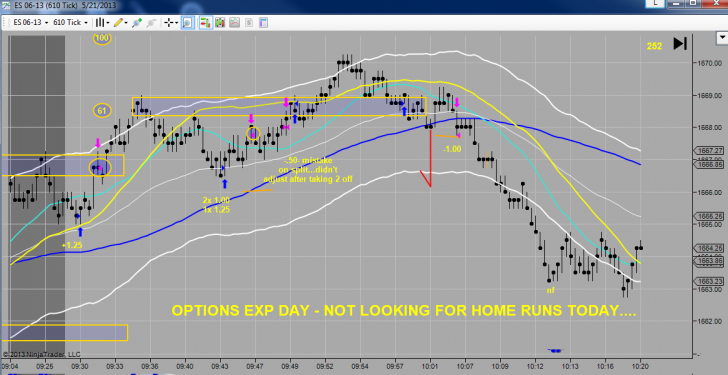

The market was a bit slow in the pre-market and wasn’t really respecting our areas to much. Although we don’t pay too much attention to the pre-market, in low volume, low volatility markets it takes the market a while to pick up steam. Add on top of this the fact that today isVIX options expiration I planned to watch my profit targets a bit more closely.

My first trade hit the target I had anticipated, but moved so quickly I had no time to move my target a bit higher. On my second trade, I was a bit more optimistic that the market could go higher so I split my targets.

I do this manually since I don’t have a Ninja Trader ATM strategy set up for this and I made a physical mistake.

I adjusted my stop once my first target got filled but did not adjust my profit target….so when it hit my target I ended up short 2 contracts…..it happens folks….you can and will make mistakes. Third trade was a compelling trade that did not work out but I had reduced my risk.

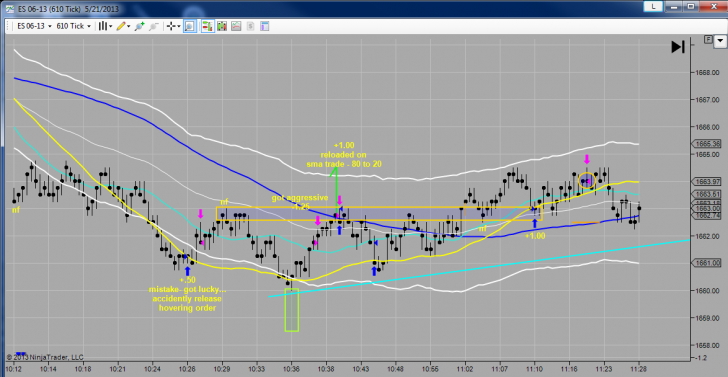

My fourth trade was another physical error. This happens when you lose focus. I was looking for one of our pro trades to set up and as I was hovering my trade entry in the area and I accidently released the mouse and it filled me.

This time I was lucky.

On the first physical error I lost 2 ticks and this one I made 2 ticks cancelling each other out less commission. Lesson learned….you need a high level of focus in this game at all times. No more staying up late at night watching movies during the week and then getting up early in the morning to run 2 miles in the heat. You’re bound to have some brain farts…lol!!!!

No fill on the following trade after the huge down turn. So I got a bit aggressive on the following trade and entered a bit sooner and got stopped out. I rarely do this, but I saw this huge run and no retrace.

Nevertheless, no worries I re-entered the market as it pivoted since the expectation was still to the downside and got out at my expected area. Dark blue line to light blue line.

This another of our pro trades. And finally my last trade was for a point.

I expected the market to retrace a bit deeper and run if it didn’t take off immediately and I was just not willing to hold through the retracement. You see I am done trading and writing and one of the many perks of trading is you can take a nap anytime you want……so let me get back to my dream….yeah, where was I? Oh, runs, retracements or stops or my, runs, retracements or stops…zzzzzzzzz

Click here to see the complete list of Market Recaps

Well done. Hopefully I will be able to take siestas after trading instead of going to work.