We scoured and reviewed nearly 5000 applicants and ended up choosing the winner for our contest to Jordan.

We offered a one year free training program using the Congressive Trading System, the tourism board of Jordan were kind enough to offer an all expenses paid trip to the country, and Ninja Trader offered a one year free live multi-license.

The Kempinski Hotel was one of the luxuries that we were able to experience while traveling through Jordan.

The luxurious Kempinski Hotel at the Dead Sea

We definitely plan on sharing the winners progress as he is now starting to sim trade and also begin understanding market dynamics.

Jordan is a country that will forever intrigued me.

Many times when we reflect on our images of the Middle East they are only of war, terrorism, and fierce debate. There are actually incredible things to see in the country and Jordan also happens to be one of the safest, if not the safest, country in the Middle East.

A quick snooze at O Beach at the Dead Sea in Jordan before the market opens

Everything from experiencing the lowest point on earth, one of the new wonders of the world, and even the best preserved Roman city outside of Italy, Jordan has a little bit of everything for everyone.

All of the people that we met, with and without the tour guide from the Jordan tourism Board, were extremely welcoming and gracious.

We started our adventure in the capital city of Amman were we would tour some ruins in addition to catching up with some locals. We visited the ancient city of Jerash which happens to be an entire city complex similar to Pompei.

The ancient city of Jerash, Jordan.

The fascinating part about Jerash is that only a fraction of the city has been excavated. Would love to be able to go back to Jordan after they have excavated more of the city!

After visiting Jerash and and consuming the delicious foods of the Middle East Tyler arrived (winner of the contest) and we sat on our way.

We visited the nature reserve, pass through the lowest point on Earth at the Dead Sea, and visited Wadi Rum. Wadi Rum is the stunning desert found in the southern part of Jordan.

Where many tourists get to know the local bed when culture of Jordan.

Camels in Wadi Rum Jordan

We got to know the local Bedouins on a completely different level.

We were able to sit in a Bedouin tent and interact with some of the locals were one of the reasons why our trip was so fantastic.

Sitting by the fireplace in the middle of the desert in the Middle East drinking Bedouin Whiskey was one of the funniest parts of the trip. Since we travel so often we bought a backup battery for the new Samsung Galaxy phone.

We were telling our guide how we paid roughly $100 for the backup battery. He told us we could have purchased the same backup battery in the market $30. Damn you Best Buy!

Here is a video that shows the great personality of the people in Jordan:

Read more about our travels to Jordan on our Jordan travel blog at WanderingTrader.com.

March 2013 Results:

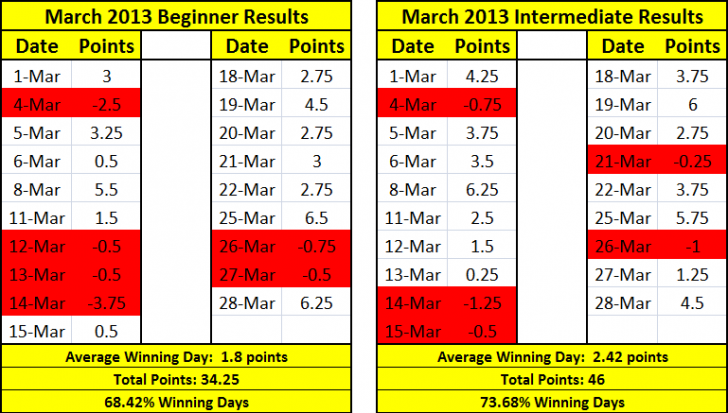

Beginners finally got a break from the January and February market movement with a closer average of roughly 2 points today. In January and February beginners would have been able to make almost a point on average every day.

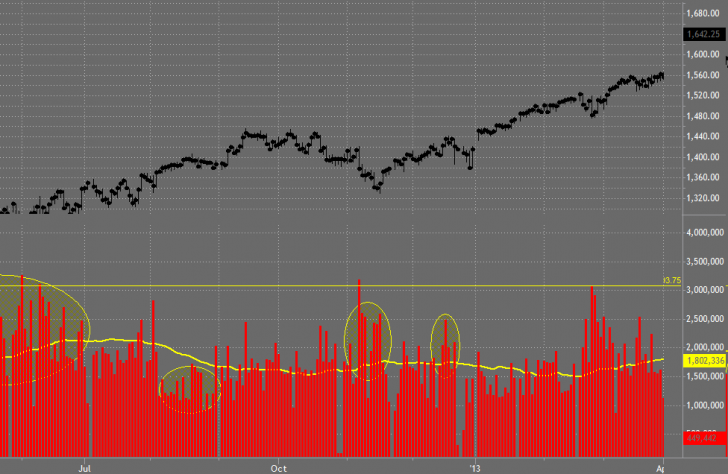

One thing that we always discuss is being able to pay attention to the current market dynamic. March brought a change which involved a spike in volume and volatility. This is the difference between the first two months of the year and March.

One can see in the chart below that the end of February and beginning of March was a was a period of high volume which brought great volatility. We had our highest volume day of the year in February but overall the volume in March was higher than February.

March stock market volume

One of the interesting things that we saw between the beginner and the intermediate results were the number of losing days. While the average daily points were higher for the intermediate results there was only one of more losing days in the beginner results.

What this signifies is that we are able to mitigate losses through risk management via the intermediate results and make more profit on winning days. There are many losing days between the beginner and intermediate results that overlap.

Neither the intermediate nor beginner results include risk management or any profit maximization.

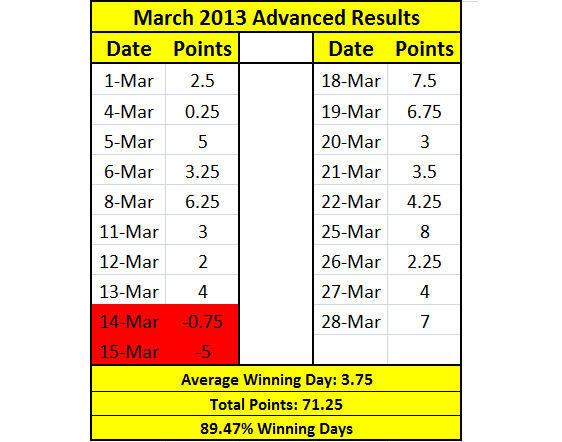

One of the most important things that we try to teach all of our traders is that it’s not about making money. At the end of the day if one follows HTS they will still be able to make money. Could they make a bit more if they were making absolutely perfect decisions? Sure. The could also make a bit less. One of the reasons why we started including our advanced results this year is to show the variation of possibilities.

Everyone should be able to make 2 points a day with us using our methodologies.

We’ve designed the program so that discipline and making the right decisions is the most important aspect that we focus on. By forcing oneself to stick to a system it builds the discipline that one eventually needs to start making money in the stock market. We do feel that everyone can make money in the stock market. At the same time sometimes we are our own worst enemy. Living day to day in a culture where expectations are for immediate results it’s hard to go at a slower pace.

Most day traders are very intelligent men and women. Many own their own businesses and have found most things in life to come very easy.

If day trading was easy everyone would be doing it.

It takes work, dedication, and even some hard times in order to make it work. One of our traders took a leave of absence from work to make a commitment to trading. Eventually when he was seeing consistency and success he quit his job only to be plagued by a losing streak.

He was down, confidence broken, but we picked up the pieces and attacked the market like we should every day. He know has been trading live for well over a year and has seen an immeasurable amount of success. What price tag would you put on being able to spend the day with your family and kids? EVERYDAY? There just isn’t a price for that and that is the reason why we do what we do. Soon we will be opening centers around the world to provide locals with the same opportunity.

Some traders decide not to follow the program as it was designed and others prefer to take shortcuts to try to obtain quicker results. We do not attest that we make every single person profitable but we know that we have seen much higher success rates than the rest of the industry.

There are other traders that do use a variation of the strategy with other techniques and methodologies. The point here is to explain that the foundation of what we teach is invaluable, being able to truly understand the market.

No software, no indicators, no “classroom educators” that have never felt the feeling of live trading before. Just good old fashioned day trading the way it was created.

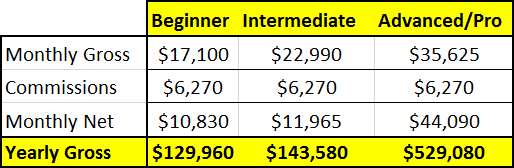

If we understand how the market works and stopped paying attention to indicators and even software we are going to be better off. Not only are we staying away from buying software and indicators but we are also going to shy away from the many scams that the industry is known for. The table below assumes 10 contracts.

If I only knew what I knew now I would not have lost $25,000 student loans when I first started trading. Buying software after software and program after program only to realize later that those sames systems could all be done manually (and easier as well).

We hope you had a successful March we look forward to the rest of 2013!

Stay profitable my friends….

Click here to see the complete list of our day trading results

Great post, so are these results only trading the Emini? All your traders just trade that? If so which time frame do you use? NY session?

The results are based on the Emini S&P 500 Steve. We have traders that trade many different instrument some even trade forex with our techniques. The time frame is based on all valid trades according to the Congressive Trading System between 9.30am EST and 1pm EST which we consider to be the morning session.

Hi Marcello

How do I get started in learning? how much money do I need to start?

thanks Marlo

See this post Marlo that will answer some questions

https://daytradingacademy.com/getting-started-day-trading/what-you-need-to-begin-day-trading