These are the kind of days that make you drool as a day trader. Today started off choppy with a support and resistance area holding in the beginning of the day but I was still able to extract a few points out of the market. It always pays to be disciplined and with the areas holding I was just looking to just get in and out.

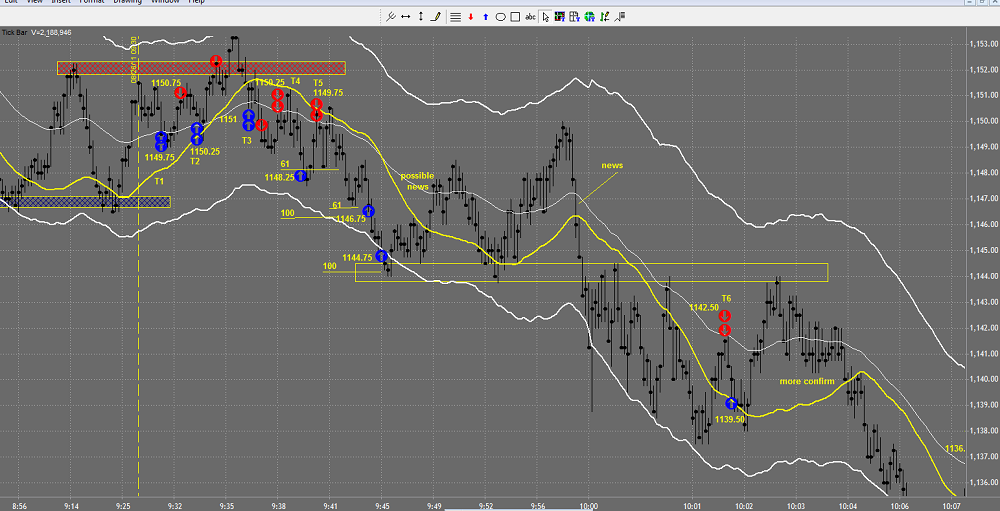

The first chart above shows trades 1 to 6 (T1 to T6). I did a better job in comparison to yesterdays recap by not accidentally labeling a trade twice. T1 and T2 were good trades especially since I decided to exit right away at the resistance area that the market was respecting. T3 was a good trade as well since the market broke out of the resistance. This is a Fake Out Break Out since the market broke above the resistance area but just got right back into the range.

Click on any of the charts to maximize them so you can the trades a bit better.

T4 and T5 worked out well also. T4 I decided to exit a bit early since the market was still working within the range. After the market popped to the downside I decided to hold T5 for a larger move in case the market broke out. You could tell by the initial move down that the market was going to break out to the downside. Take a look at the difference in behavior from the moves to the upside in comparison to the moves to the downside. I used a split target approach where I stuck with a 3 pt target and let the other half of the position run for 5 pts.

Once the Ben Bernanke news came out that sent the market racing and I decided to just stick with a 2 point target due to the volatility with the market. Sometimes after news there is a lot of indecision and the market can run in one direction and then quickly move in the opposite direction.

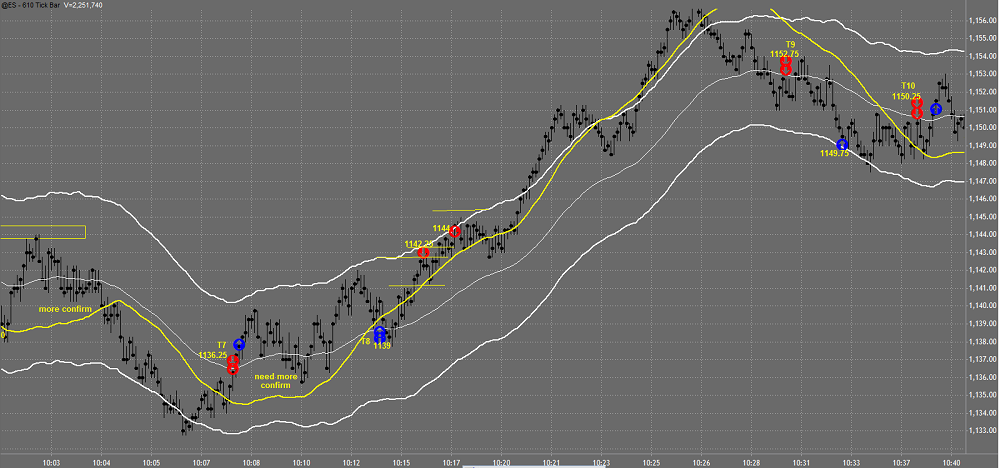

We had a brief move to the upside which didn’t have enough confirmation up so I decided not to take any longs. Once the market confirmed that it was continuing to move to the downside I took an additional short (T7) which was a loss. Still a good trade. The market then stuck around for a bit tempting me to go long but I still needed to see more confirmation. Once we got the pop up I decided to go for it and the market just ran.

I never feel bad when the market runs without me because I know that trade netted me 5 points on the second target. With the increased market volatility I plan on letting some contracts run to catch those very big 8 and 10 point winners

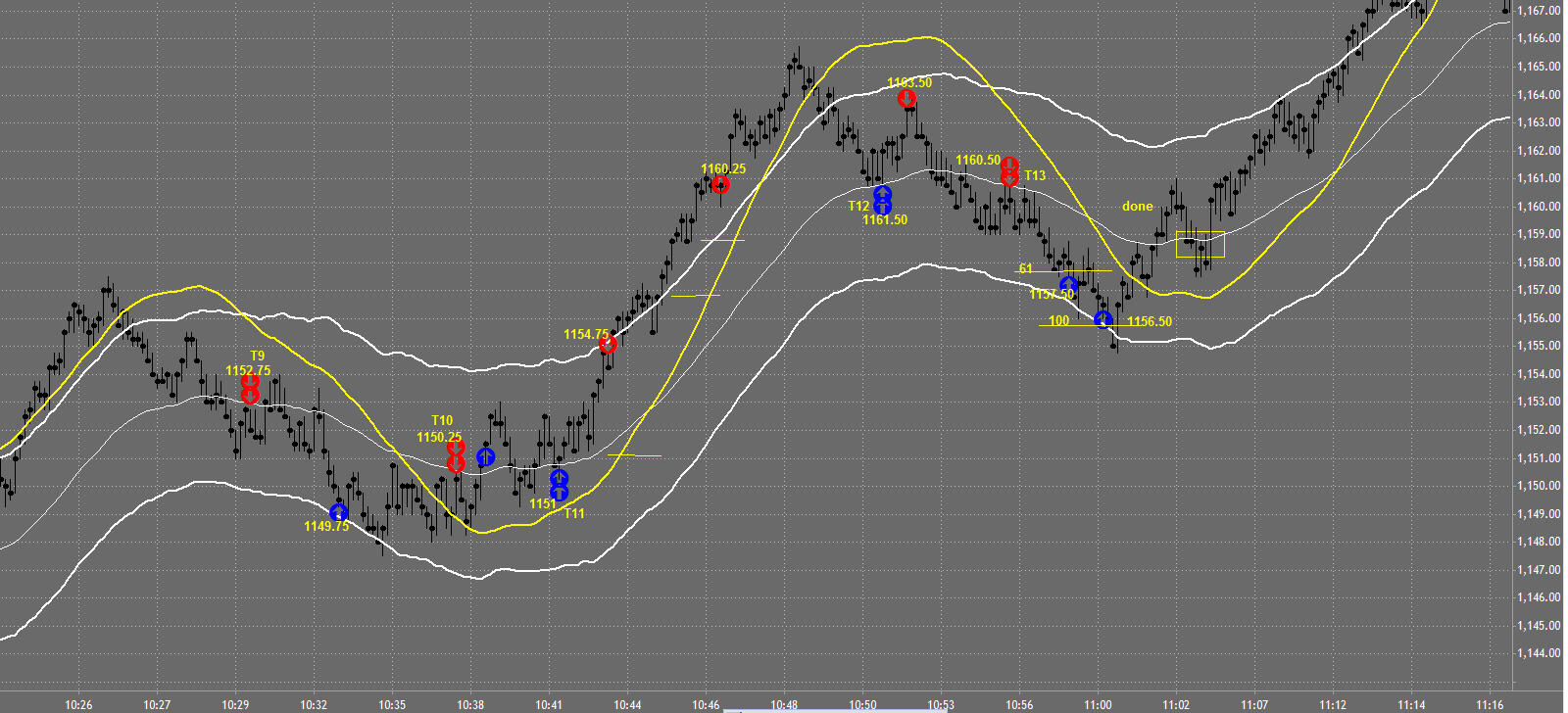

There was a potential trade just before T9 but I didn’t take because I didn’t like the entry. T9 worked out nicely to the downside and T10 was a good trade that just didn’t work. The dynamic at this point in the market has changed as the market was moving down for most of the day. Now you can see the overall market movement is up. I took T11 without hesitation to the upside and you can see the adjustments in my 2nd target.

There was an incredible amount of strength to the upside so I decided to minimize my risk by tightening my stop and getting out at 1160.25 after the market overran the outer band significantly. Another long at T12 worked out and then the market momentum shifted back down. After T13 I decided to call it a day. After 11am today the market slowed significantly but there was still good opportunities.

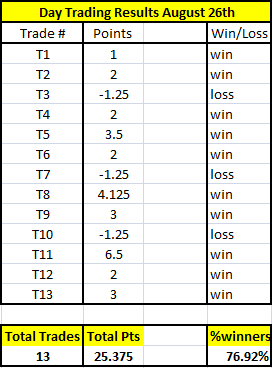

- 10 out of 13 are winners

- 18 Total Trades Available

- 5 trades not taken:

- News

- Not enough confirmation

- Entry Pattern/Strength

After T7 you say more confirmation for a long is required, yet at 10:31 you didn’t need extra confirmation for a short. In both cases the trades were against reasonably strong preceding opposing runs. The difference between the two that I see is the angle of the LRC. Is that what made the difference?

Didn’t need extra confirmation at 10.31 because most of the day was down excluding this run up.. was willing to give it a try since most of the day was down.. placed less weight on the run to the upside because of the down day