Meet Jonathan!

One of these successful members of the LTD Project that we plan on highlighting over the next few months.

Jonathan has been focusing on trading the Emini S&P 500 at has also started to focus on the 6E. One of the things that we admire about Jonathan is his discipline and focuse.

We would never recommend anyone trading their own account live before they find consistency on a simulation account.

When we first discussed Jonathan joining the LTD Project he insisted on the trading his own account live to ensure he would make the same decisions in a live environment as he would on a simulation account.

Over the course of his first month trading with the Day Trading Academy he only lost $12.50. Day trading is a skill that one has to develop and the efficiency and power of the Congressive Trading System is shown with Jonathan’s results.

Without any prior knowledge of any DTA techniques he started trading his account live and only lost $12.50 (including all commissions) in his first month of trading.

This mainly is due to the high risk versus reward ratios that are encompassed within the system. In addition to that, risk management has been effectively employed to ensure that losses remained minimal.

Jonathan has now begun to trade with his own style and understand what he feels comfortable with. Trading with a Congressive mindset means paying attention to the market rather than indicators and also trading the way you feel comfortable.

Whether a trader is aggressive, conservative, or right in between (Congressive), they can definitely find success with in the program. This is one of the vital keys of how we have been able to improve industry success rates by over 300% to one out of three traders.

Read below as Jonathan details his trades in his own words:

———————————————

Well, this is an interesting week to be writing my first recap article for TheDayTradingAcademy.

After the NY Trader’s expo last week, I began trading live in the 6E market every day, between 5-7am Eastern time. After a few days of good movement and consistently profitable trading, I entered the market on Friday morning with the same confidence.

Leave it to the markets to throw a monkey wrench in our plans.

As always, I had started the session by checking for any news that may cause erratic behavior in the market.

Part of The Day Tradng Academy team & students (from left to right, Jeremy, Jonathan, Marcello Arrambide, Rick)

The only item I noticed was an Italian Retail news item at 6am, but since it was marked as a “low-impact” news item, there was no need to stop trading. Unfortunately, the rest of the market seemed to think it was pretty important, and mere seconds after entering a long position, the market SHOT to the downside, so quickly that my protective stop was utterly ignored.

I sat for a second or two, dumbfounded, and not understanding why the trade was 30-some ticks against me, and my 5-tick stop was just sitting there, unfilled. After hitting the ole’ panic button, (close), that single news spike had cost me 31-ticks.

Needless to say, my confidence in the 6E was a bit shaken, but my confidence in my decisions remained.

Sometimes, um… “stuff”… just happens. After talking to an experienced 6E trader, I’ve decided not to hold through ANY news in those hours which is known to affect the Euro. But I was back on the horse this morning.

The 6E session actually ended up being a little bit boring for me today, as the “trade of the day” ended up being a “no fill” on my order waiting, and I watched the market for a full hour before seeing anything else that I found compelling.

(I’m not a morning person, and a dark, quiet house at 5:30am doesn’t exactly help me to stay awake and keep my attention focused.)

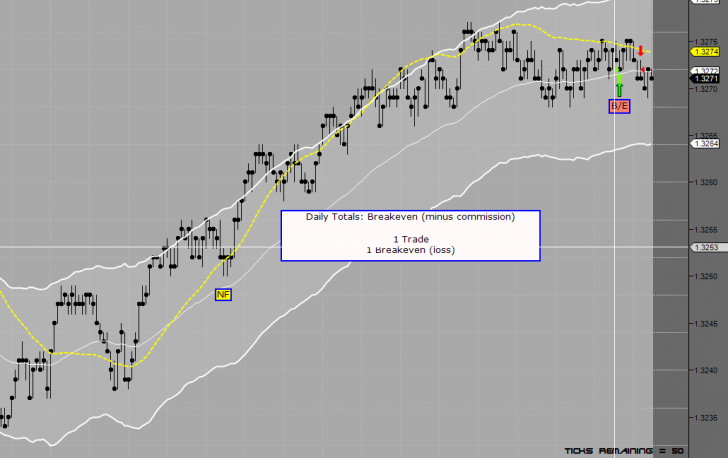

I only made one other trade in that session, but was proud of my decision to exit this aggressive trade with a “break-even” instead of the unnecessary loss it would have otherwise been.

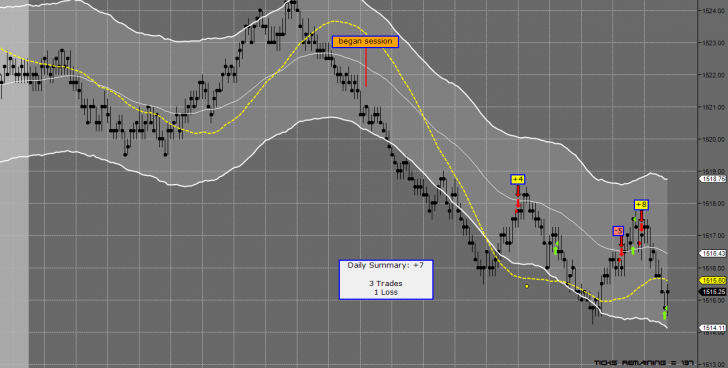

I ended up going back to bed, catching a few extra hours sleep, and waking up to see the ES market, (S&P E-Mini) taking off to the downside. If there’s one thing that learning with The Day Trading Academy has taught me, it’s not to be afraid to jump right into the trading when you can clearly see the momentum of the market. Today ended up being a great step in recovering Friday’s freakish loss!

News spikes be-damned: the moral of the story is that consistently making the right decisions is more powerful than the “freak” events that the markets can throw at us, on those rare occasions.

Click here to see the complete list of Market Recaps