right now in our live market analysis class we have one of our master traders, the hit man himself Nikolai, doing a one on one in Germany. Something new that we plan on introducing into the training program where we offer one on one training in a live market environment.

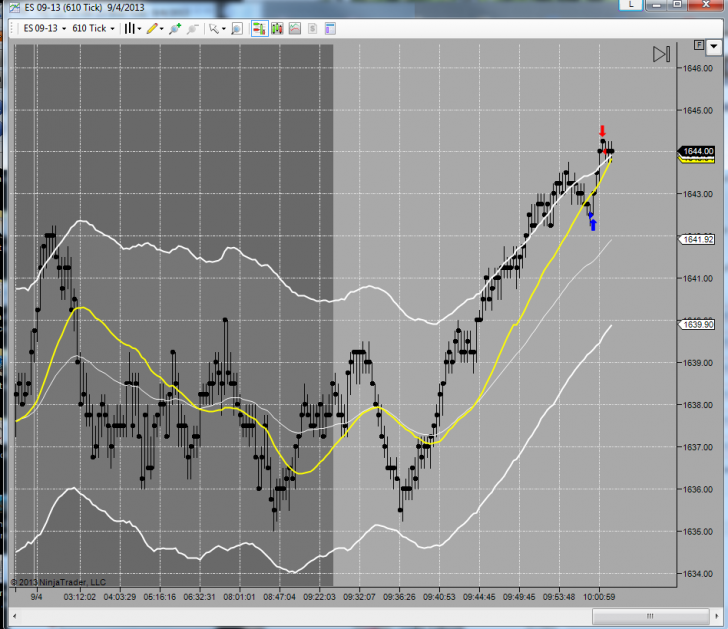

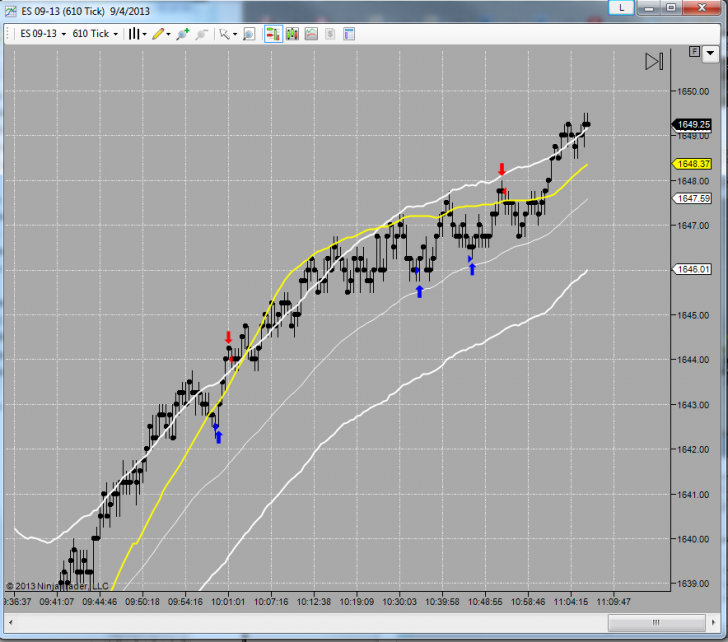

So far we have seen a pretty strong push to the upside and are waiting for a valid setup.

Looking for the market to give us a bit of a pull back here. This is the only problem sometimes with strong trending days where the market just won’t give us a pullback. If it does pull back here it will probably give us a deeper retracement.

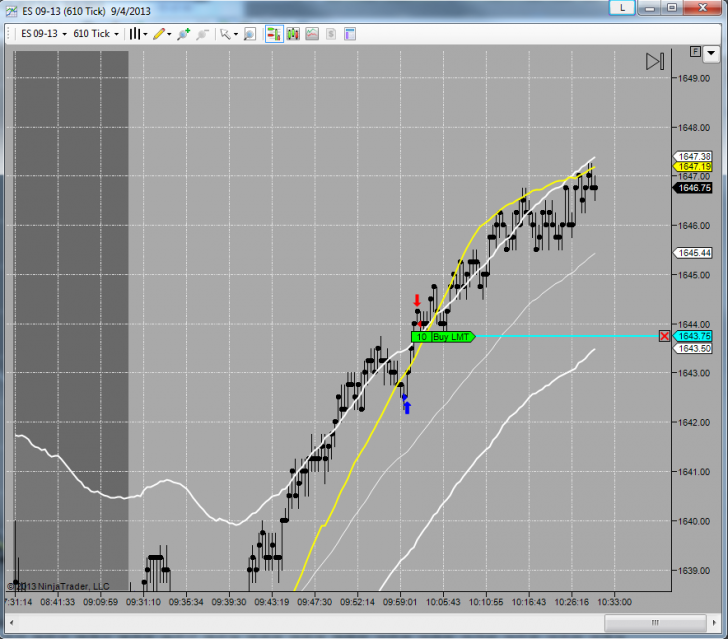

Even though the market is probably going to head higher I decided it wasn’t worth waiting for more movement to the upside with 4.5 points for the day. Nikolai & Aaron in the live class pointed out that this would be the kind of situation where we would be willing to lose a full loss to make sure it was going to work.

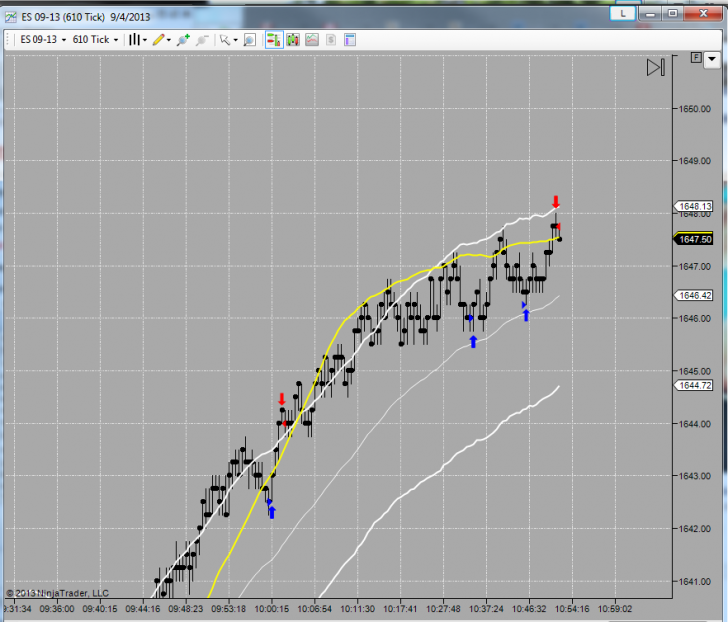

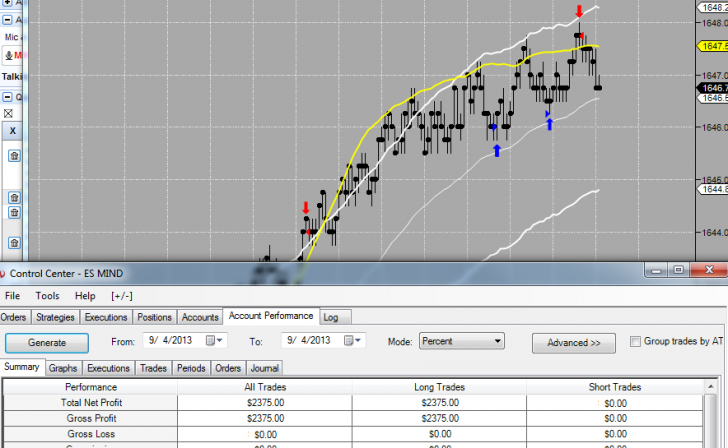

Here is the final chart with a little sneak peak at what is possible. Doesn’t matter if you are trading with one contract or 10 contracts, it’s all about making the right decision and being able to consistently extract a profit from the market every single day.

And as you see the market did indeed continue to the upside. Some of us feel that we should have made more and more money and in retrospect we could go back and say well I should have held. We could always say a lot of things after the fact and the truth is the market today was inclined to continue up. It had very strong momentum to the upside and we could have held for more but the question is really this… isn’t it enough that we made 4.5 points? I think so. Hope you had a great day like many of our students in the live market class today.

+4.75.

Ha I was trying to be conservative 😉

I’ve noticed that you use 610 and 233 tick charts when you trade the e-mini, I I recall you’ve said it has something to do with fibonacci. How do you do when you trade the 6E? Do you still use the same tick charts even though the volume is substantially smaller or do you use different values?

Every market has a different setup Steve but we don’t really use the 233 chart any more. That is used more with our pro traders to use for more advanced setups and trades. There is a new trade that we are looking at called the Waterfalls trade that correlates the 233 chart directly. We have a few different ways that we trade the 6E really would depend what kind of trader you are Steve. We prefer to identify our trader’s behaviors and then use that to hone their trading using a dynamic rules based system.

Hello Marcello,

i’m from Cologne in Germany and i’am very impressed of you trading methods.

Michael

Hey Michael.. we give all the trade setups and the indicator settings to everyone in the program. The indicators aren’t important so much as it is important to read the market Michael. We start everyone with indicators but later everyone either starts to develop their own style of trading within the framework with extra indicators and even without indicators.