The video is up and we bring you a bit of insight into market behavior and recognizing it without over complicating the process.

I don’t always recommend getting up late but when you do, you should make 8 points. That’s what it seemed like today anyway. It seems as though anytime we have biggest developments or changes with the Day Trading Academy there is always Ethiopian coffee or sushi involved.

Last night was no different as we had six new traders sign up for our new trading center here in Colombia. We plan on sharing a more detailed update, but safe to say there were seven men, nearly 200 pieces of sushi, and contracts that would bind us together for years to come.

We even have discussed the possibility with one of the most prominent universities and Latin America, EAFIT, to provide internships to the students to teach them how to trade. Next week we will also be heading to both in order to discuss the day trading symposium which is something we are honored to have been invited to speak at.

The staff here at The Day Trading Academy is really excited about the things to come and also our new penthouse, which we will call home for our very first day trading center here in Colombia. The vision is to be able to provide one on one training in several exotic locations around the world while we continue traveling and day trading around the world.

All while having the opportunity to sit next to one of our local traders who is already trading an account live.

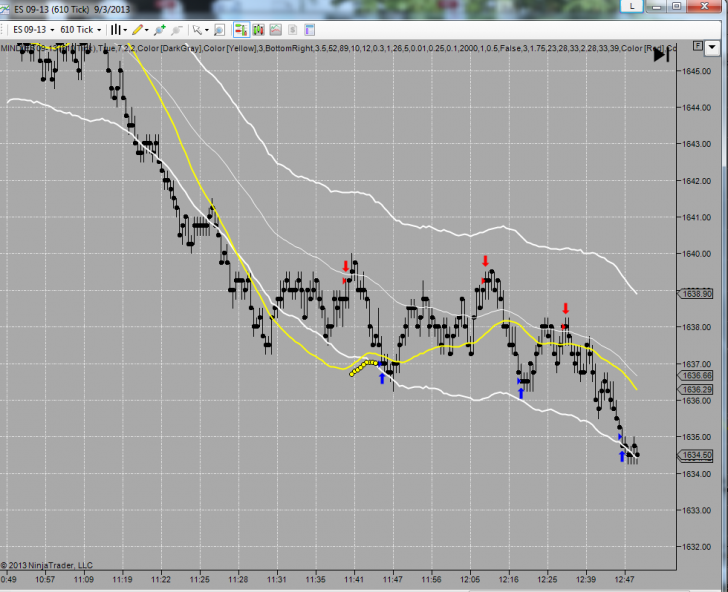

The market activity today really represents the kind of market that we have seen in the last few years. Changes in behavior occurring rapidly and not necessarily changes that we like. The morning session started with a nice run any immediately once news arrived we saw very choppy behavior. The market channeled in between an area of support and a trendline area of resistance.

I was able to watch the end of this behavior and watch the breakout to the downside. Whenever we see this kind of momentum that is when we decide to pull the trigger and look for excuses to enter the market.

Many traders try to get into trades based on guidelines and rules.

Sometimes we make exceptions, reading underlying behavior as we teach out traders to understand and take advantage of market momentum. With this kind of momentum I was looking for any excuse to enter the market. The first and last trade did fit all rules for valid setups the second however would be considered one of our “Pro” trades.

Look forward to getting back into the swing of things as we have spoken to many of you that have been requesting more market recaps. Have a great week trading and always remember to stay profitable.

Click here to see all of the market recaps

Thanks for the recap. keep them coming, This is how a poor man learns

My pleasure Ed 🙂