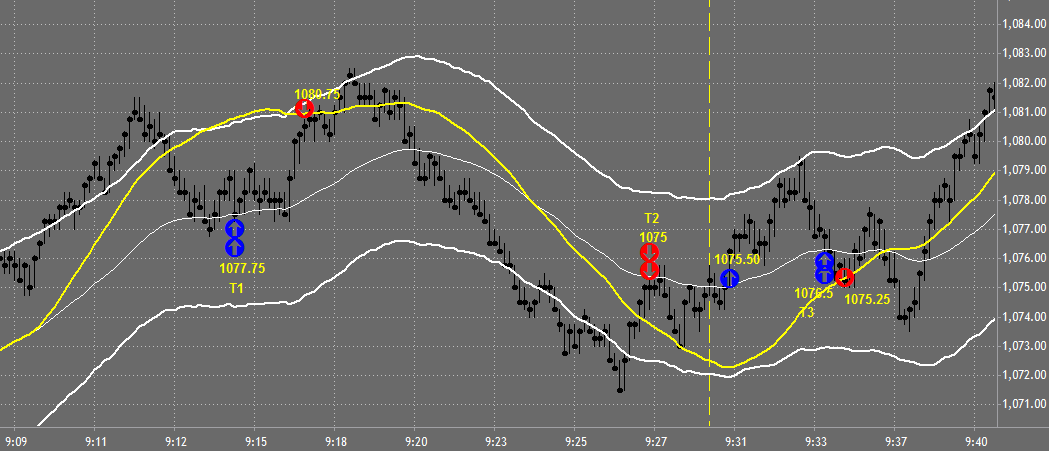

I started looking at the market a bit earlier because there has been good movement in the premarket. It has worked out well so far especially since there is a great restaurant I have started to frequent every day. The first trade is a bit aggressive because the market overran our areas but the momentum was still there. Worked out very well if you notice, aggressive in, aggressive out. Didn’t look for a massive run just got out at the first area.

Click on the chart to enlarge

The next trades were good trades but just didn’t work out. Today turned out very similar to yesterday’s trading were I had a poor win ratio, notice I am only up 33% with only 1.75 points. Should you panic in this situation? Start taking aggressive trades and NOT following your plan because you just want to make that money back. No.

Stick to your plan, if you are making money why start changing your behavior?

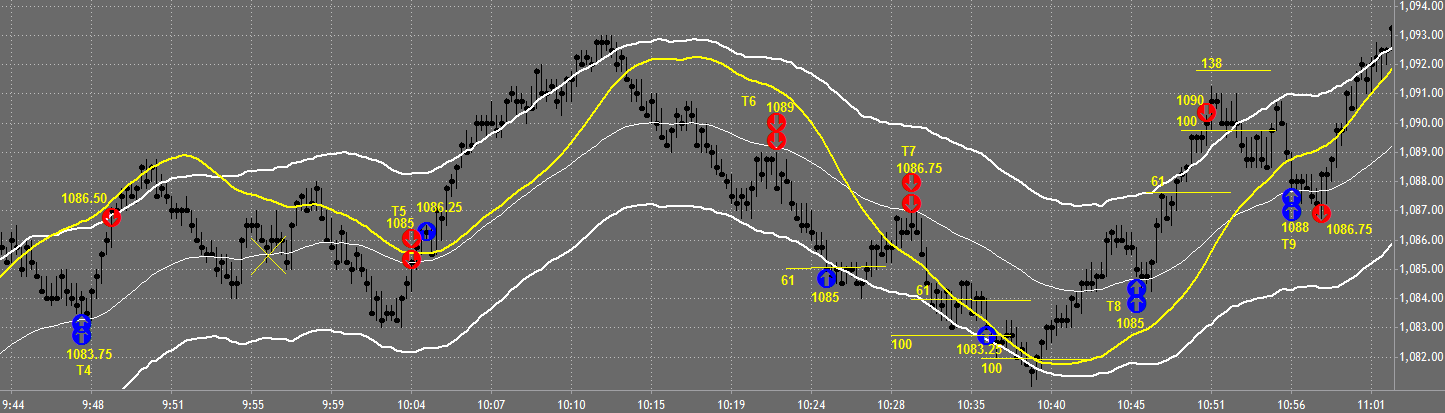

T4 was a great trade that worked out very well and T5 was a good trade as well that just didn’t work out. I have reviewed my trading over the last few days and have realized that I have been making excellent decisions in the market.

I ended the day very strong with 75% winners in the later part of the morning and I more than made up for the lousy early morning. This is one of the reasons why I love trading the way I do, the market can change so quickly and you are able to do very well in a very short period of time.

Notice the difference on T8 where I held for the full 5 points.

There is a pretty important pop that happened from the midband to the outerband which indicated that the market was going to run. Whenever you see this kind of pop there is generally a small slow down and another pop which you can see in the next movement; pop from 1084.25 to 1087.5, then a slowdown at 1087, another pop at 1087 to 1089, consolidation at 1089.50, the final pop to 1091.25, and the final (and significant) consolidation between 1090 to 1091.

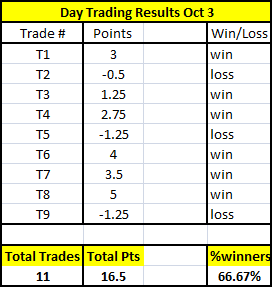

Day Trading Results For Today

- Total of 9 trades (not 11)

- 6 winning trades

- 3 losing trades

- 66.67% winners

66% is a good ratio, i always used to have under 50% winners (well not always) but was high frequency trading with reasonable size in The Futures – Have little to do with the Markets these days, Its not the same hitting a button when you are used to Open Outcry – will keep popping by to see how you are doing

cheers

Tristan

Thanks Tristan!

Gday I was just reviwing your trading, congrats was a good day! man ,, I`ve been studying for years every day,, now finally I`m starting to getting profitable.. I guess I use a similiar strategy, where I intend tu buy pullbacks on a confirmation that it will be a continuatio pattern in the E-MINIS so then I go for a stock that is in a good short or long pullback and place the trade, it have been the only system that is working out for me, I use pivot points, I do have 200SMA and 20SMA but they are not the principal, they are just warning for not to place a trade instead of helping to make one. well if you have any trading tips like how do you measure the pull backs, or how do you define a downtrend or uptrend I`m more them happy to know and share any of my experience! thanks dude

Guilherme guilherme.seixas@gmail.com

Hi Guilherme.. I use basic indicators that can be found in any day trading book. I try to keep it as simple as possible because I think that when you over complicate things, thats when you run into trouble. Happy to hear that you are finally getting profitable! Great job!