I have officially arrived in Madagascar! I would have loved to start day trading here in this fascinating country but I can already tell that the internet speeds for day trading are atrocious. They recently installed a new underwater sea cable from South Africa but it is the interior of the country.

I inputted a few sim orders and it took the system a few seconds to put in the order and cancel it. If it takes that long to read a simulation order I’m not going to place my bets on any live orders.

Much of the time I will be spending here in Madagascar will be without internet since many of the places I would like to see are very remote. Once I get to the coast I will have internet access again and will be able to test the speeds there.

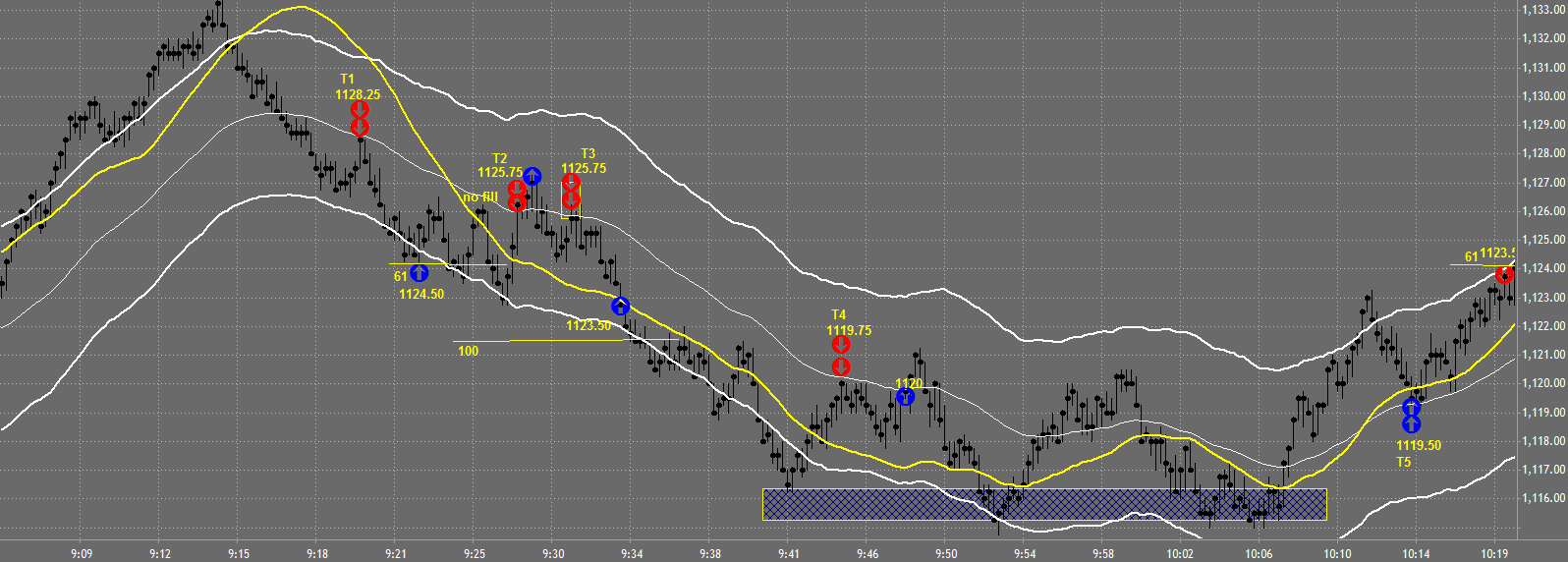

Day trading on October 3rd didn’t start out well. I was 50% profitable in the first half hour aside from being up 4.5 points. That is the big advantage of using a day trading strategy where you win more than you lose and also have larger winners than losers. T1 is a picture perfect trade and gauging the momentum of the trade I decided to look for the first area around 1124.50.

Click on any of the charts to enlarge them

T2 was a trade that I did want to take at first, once we had that strong retracement to the mid band I immediately tried to cancel my order. The market moved too quick and I was stopped out for a full 5 ticks, sometimes the volume trigger on Ninja Trader saves me here but you can’t always be a winner. I immediately jumped back in at T3 and got out at the first area since I wasn’t able to move my target quick enough.

T4 was an exceptional trade since there was great momentum to the downside in the market. I was looking for the market to continue just a bit lower and I was stopped out for a tick. I would be willing to risk 1 tick on any trade.

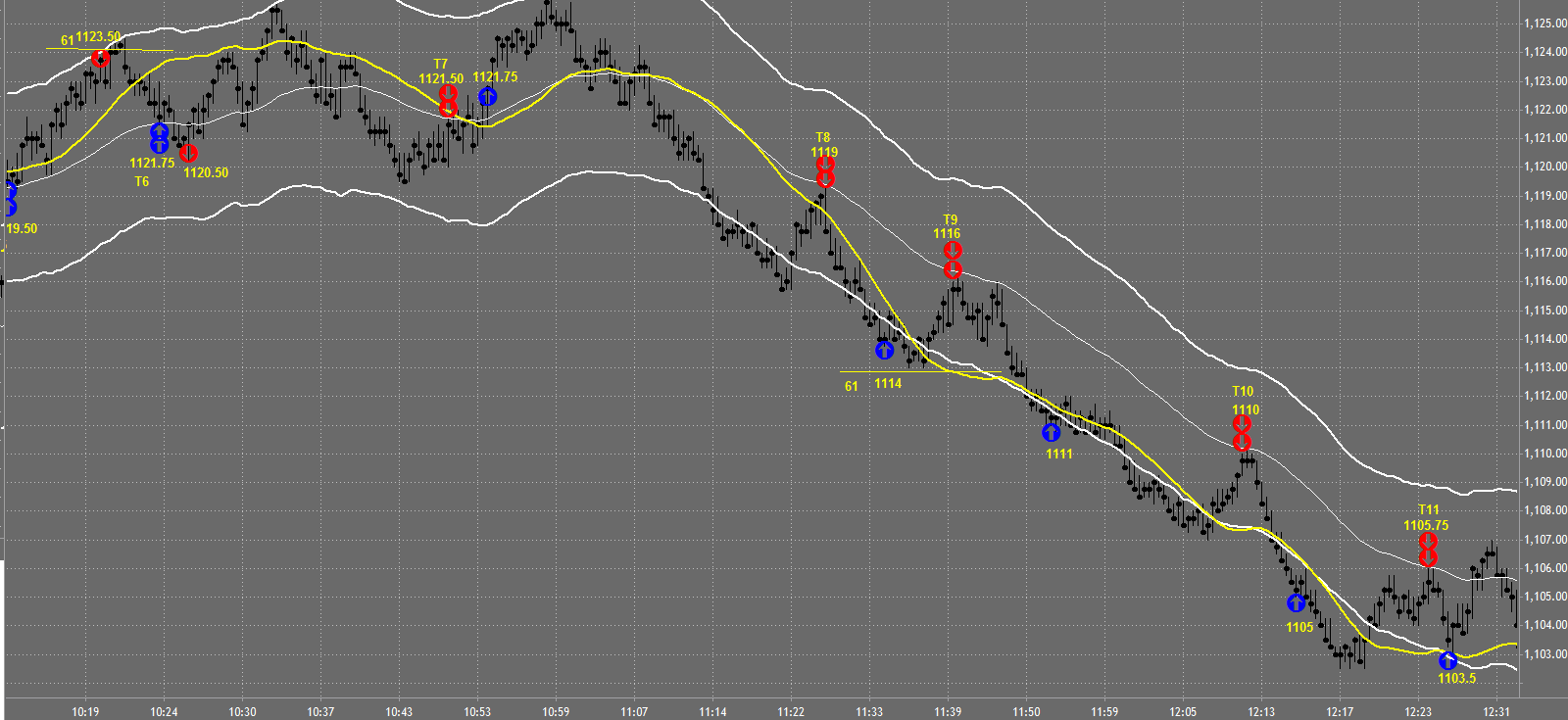

T5 and T6 were perfect trades as well, one worked out for 4 points and the other took a deeper retracement and I was stopped out. T7 also is a great trade that just didn’t work out. Many times you have to understand that you take good trades that just don’t win. Losing is part of the game.

All the trades after T8 was when the market really opened up. These are times when you want to take your trading to the limit and maximize your results. You can really see after the beginning of T8 that the market was going to run. A very weak retracement at T9 showed the same thing. T9 is the type of trade that I normally get out at the first area but with this momentum I would be a fool not to keep pushing the limit.

Take a look at how far T10 ran, a total of 7.5 points. My max target on any trade is 5 pts, did I get upset after it ran an additional 2.5 points? Absolutely not. I have a strategy that I use and is effective in the market, anytime that you get greedy you start losing money. If I am able to make 5 points on any trade I am extremely happy. If the market keeps running, so be it.

T11 was a quick 2.25 points and its very important to understand how the market works. After such a large run to the downside you can’t keep pressing your luck, especially when the market has already taken a nose dive with a lot of strength.

The stock market never goes in one direction without stopping.

It’s very similar to how you take a sprint in one direction, you can’t run at full speed forever. You have to stop and catch your breathe before you start the next sprint. The reason why this happens in the stock market is because of human emotion. If you are winning a trade you want to bank your profit, if you’re losing a trade you want to get out. There are also going to be people that try to call the low or high of the market. Throw this all together and that is what explains the movement in the market.

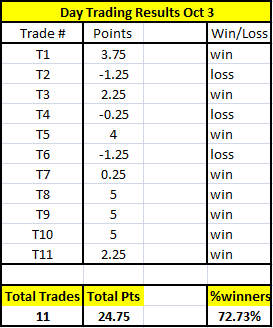

Day Trading Results for Today

- Total of 11 trades

- 8 winning trades

- 3 losing trades

- 1 trade not filled

Great trading, Marcello! If I may ask, what did you use for Volume Trigger value on this day? Do you change the value depending on the market environment? Keep ’em coming! And enjoy Madagascar!!

i always use 10-15 Nikolai.. 10 on low volume days and 15 high volume days

Interesting…I use 300 and although it works on low volume/volatility days, on other days I get a tick or even two of slippage on the stop fill about 80% of the time. Just to be clear: the volume trigger value I talk about is set @ the bottom most field under Custom tab on NT ATM strategy and the value represents the number under which the bid or ask should fall in order for the stop order to be sent to the exchange… are we on the same page?

Thanks, Marcello. I wish you had more time for trading so that you could feed us more Trading Recaps! Enjoy whatever exotic place you are at now!

Yes that sounds right with the Volume Trigger.. it is labelled volume trigger so make sure it says that you should be good to go