Wow has it been a busy 2 weeks. I haven’t been trading because I was invited by the Israel Ministry of Tourism to tour the country of Israel. If you want to check out how the trip went check out my my travel blog. I originally had planned to update just market recaps instead of my trades but the schedule was so hectic I was only getting 2-4 hours of sleep for an entire two weeks. I returned to Kenya last Friday and was able to start trading again on Monday the 26th.

I’m always hesitant to go full throttle after I come back from a long trip or I haven’t traded for over week. Luckily, the market has been moving incredibly well. On Monday, I simply started studying the past 2 weeks of activity for roughly 10 minutes followed by my 5 minute analysis of the current days activity. I did notice that there has been exceptional swings in the market especially early in the morning.

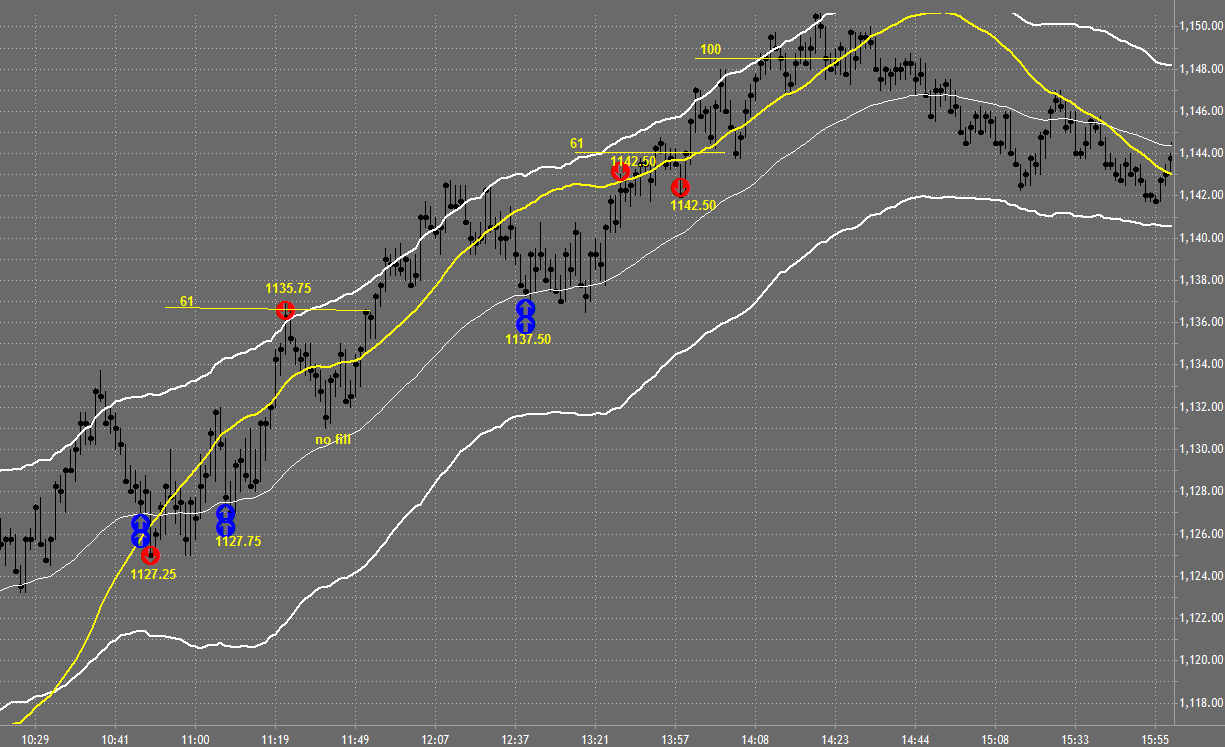

Click on the charts to make them larger

I immediately pulled my automatic 2 pt target and based my targets on the fib levels. My first trade was a full loss of 5 ticks. I did debate adjusting to a larger stop based on the swings in the market but it wouldn’t have made a difference since the market retraced roughly 2 pts behind my entry. Once I was stopped out I immediately looked for a re-entry. I missed the entry at 11am but the market was nice enough to give me another opportunity.

There was a major resistance area going back to Friday that the market was respecting at about 1133. Once I entered I immediately covered my risk and tightened my stop. My target was a few ticks under the 61% extension.

I wasn’t able to get filled on the third trade for the day but I did get an excellent 4th (and last) trade. I used a split target technique for this trade and since the market had a great run to the upside I was planning to let her run for at least 8 pts. If you see the chart below I was prepared to hold all the way to the cyan area where there was a convergence of areas. I was greedy and brought my stop up too tight and was stopped out instead of being able to hold. Looks great after the fact doesn’t it?

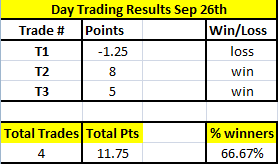

Today’s Day Trading Results

- Total of 3 trades

- Won 2 out of 3 trades

- Lost 1 trade

- 1 trade not fill

Hey Marcello. Is that first trade at 0345 US ET? Are you concentrating on time frames that suit your own time zone rather than US regular hours or is this an exception because of the volatility?

Hey Sanj… that was actually an error on my charts. I will be talking about that tomorrow on tuesday’s recap how my chart was formatted with the wrong time and I actually started trading at the wrong time. Still worked out well but it was by chance of luck. I still trade normal market hours

Nice when the strategy protects your downside in an incorrect trade and it works out like that. Am spending more time on 6E myself now as times really work well for me in Europe. Trying to finish up by 10AM instead of 6PM. So far so good.

Thats great Sanj.. I have considered the 6E but have stuck with the ES to start trading at around 4.30pm here in Africa. I hate to wake up in the morning! lol

Great trades! These recaps act as solid motivators for me!! Keep ’em coming!

Monday’s regular trading hours were also very clean and trade-able moves. I was 7 for 8 with almost 16 points before the lunch hour and closed it for the day… a personal best.

Thanks Nikolai.. that sounds great!! Love to hear about your success 🙂