WOAH! One of the things that I hate about not being connected to the world (example: my trading charts) is that too many things can change in a short amount of time. In, for example, the two weeks that I was in Israel and didn’t even look at a chart. If you take a look at my market recap from yesterday you will find that my time at the bottom of the chart is set to local instead of exchange. I was actually trading the pre-market on Monday rather than the regular market.

When I went back and did my research turns out my charts were still on local time rather than eastern time. Luckily, when you trade its the same in the pre-market as the regular market. I was wondering why the market was moving so slow.

I haven’t been trading nearly as long recently because I can make less points with more and more contracts. In addition to that, I am working on a project on this site to train someone from knowing nothing about trading to teaching him everything I have learned in my near 10 year career. Check out the Learning How to Day Trade Project for updates.

It’s taking a lot of time and energy out of me and I’ve also received many requests for personal coaching which is something I am considering. What I don’t know is how to manage by hectic travel schedule with day trading, running my travel blog, AND coaching. I may just consider it on a person by person basis.

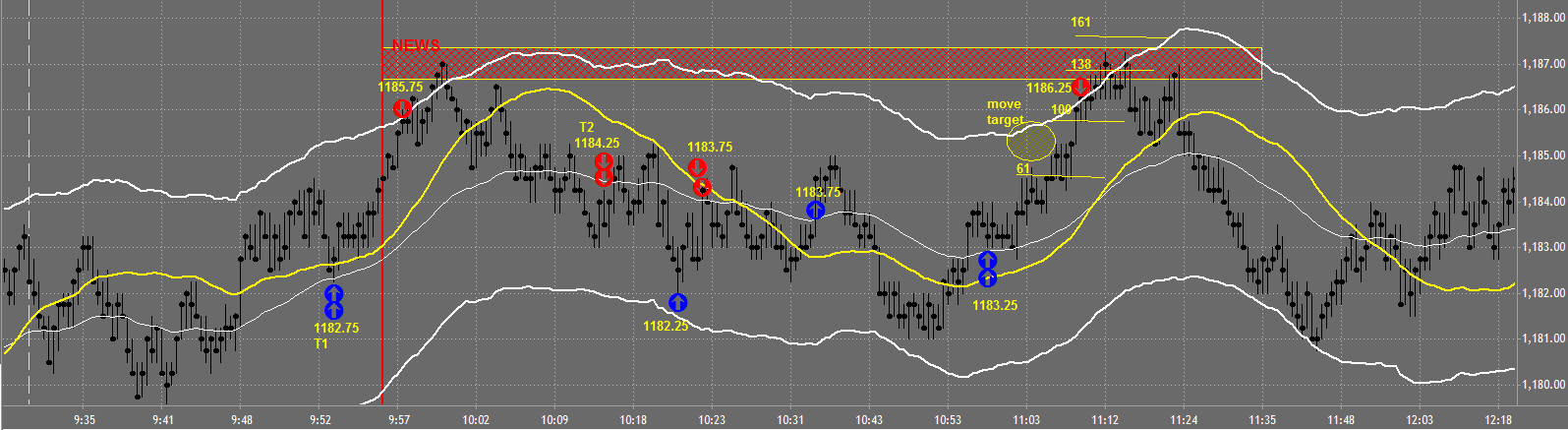

CLICK ON THE CHART TO ENLARGE

T1 I wouldn’t say is an aggressive trade but it isn’t the most conservative trades that the market provides either. I originally had my 2 pt target set but realized that there was a resistance at around 1186. With the market finally giving us a nice move to the upside I decided to adjust my target to 3 pts which would coincide with the resistance area and outerband.

The market changes its course off the resistance area (surprise!) and heads to the downside. I take T2 and leave my 2 pt target in place simply because the market isn’t giving us those big swings. Turns out to be a good decision and I get out with 2 pts almost on the edge. I immediately reload on T3 and as I adjust my stop to minimize my risk I get out with a break even.

There was a potential short at 10.55 which I should have taken. There is honestly no reason why I didn’t take this trade other than being distracted on the internet. I honestly became a bit disenchanted with the market after 5 pts since I have been trying to catch up with so many projects. After it started setting up (telling myself I should be paying attention) and then not working (telling myself its a good thing I didn’t take it), I took trade T4 to the upside for 3 points.

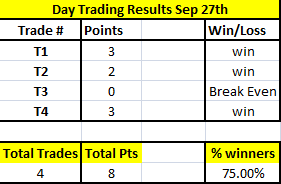

Day Trading Results Sep 27th

- Total of 4 trades taken

- 3 winning trades

- 1 break even trade

- (counts as loss due to commissions)

Click here to see the complete list of Market Recaps