The impact of debt on the value of the dollar is being closely watched by domestic and international investors.

In a previous article concerning the decline of the dollar we discussed the evolution of the dollar in the second half of the 20th century.

The decline in the value of the dollar over a generation was coupled with economic growth and a continuing rise in the standard of living for many Americans.

The shrinking dollar was a cost that most Americans seemed willing to endure over these years.

Besides the choice was never really given to voters that government expansion would necessitate the devaluation of the dollar because part of this expansion would be paid for with the issuance of debt first at home but increasingly sold abroad as the 21st century dawned.

Politicians irresponsibly were making present and future promises that were going to be unsustainable given the low tolerance of Americans for higher personal income taxes. The impact of the debt on the value of the dollar was accepted as an acceptable alternative to slowing down government spending.

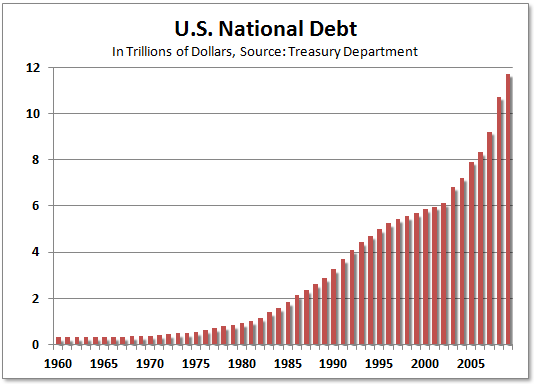

United States National Debt

The acceleration of debt began in earnest during the George Bush Junior Administration.

Tax cuts were passed to spur new economic growth but there were no real cuts to government spending so deficits to the tune of several hundred billion dollars a year were the result.

A new government program was passed to assist seniors in the purchase of drugs and two ongoing wars were begun that were not going to be paid for. It is not the purpose of this article to assign blame to a political party but rather explain that these were decisions made by politicians of both parties.

Loyalty to the party orthodoxy and leadership became paramount. Helping the politicians with re-election was more important than figuring out what would be in the best interest of the country at large.

Short term political gains were therefore always going to be paid for in the long term.

The policy of “kicking the can down the road” became a doctrine which many politicians across the spectrum of political philosophy embraced for obvious reasons. Somebody else can pay for the bill later. A simple observation of the official debt clock of the United States clearly illustrates how overwhelming this problem has now become

It was already at this time that some economists looking at the long term trends were sounding the alarm that the huge costs of medical and other pension liabilities were becoming unsustainable.

This is without a collapse in the value of the dollar. The unfunded liabilities were rapidly heading towards the 100 trillion mark.

Then came the turmoil of 2007 in real estate and the banking and mortgage disaster of 2008. With the American economy in free fall and the housing market in a state of collapse it looked like a number of large banks were ready to go under.

The speculative bubble in real estate and mortgage backed securities had imploded.

It was only then that Americans learned that their government had not only encouraged but insisted that money be lent to individuals and businesses with little ability to repay the principle never mind the interest.

Of course these mortgages were bundled and resold abroad as well so these toxic assets were part of the portfolios of both domestic and international banks, insurance companies, pension funds, securities and so forth.

When Americans obsessed about tax payer money being used to bail out firms overseas they failed to recognize how interdependent the American financial system had become to a world system.

Hundreds of billions of dollars were given as “loans” to a number of financial institutions as well as the major commercial banks. The American government also began programs of rescue for a number of companies like General Motors as the Bush Administration was ending.

The Obama Administration accelerated this help and under the guise of stimulating the economy back to growth passed a massive stimulus bill close to 800 billion.

Not wanting to go through the full pain of economic deconstruction in order to allow real new economic growth the government attempted to artificially stimulate the economy like a shot of adrenaline.

One can argue what might of happened otherwise but one result was a huge new amount of debt added to an already immense pile. Increased government spending on social spending to ease the pain of recession added to it. Soon a trillion new dollars of spending were being added yearly and the unfunded wars continued to add 300 billion more as well.

Deficits of 1 trillion plus now became the norm. How this new accumulation of debt would impact the value of the dollar was not an issue that Congress was ready to act on.

To make matters worse the Obama Administration and Congress added a huge new entitlement which basically is nationalized health care. The true meaning being every American is “entitled” to health care provided by all tax payers. The federal government was now “borrowing” 40 cents of every dollar spent. In a later article we will discover how this shortfall is actually being funded.

The methods now being used by our Federal Reserve is moving the American dollar towards collapse at a much accelerated pace.