This is recap by one of our graduate master traders. All the traders in the Elite Mentoring Program know exactly who every trader is and have their contact information as well. We plan on sharing more traders charts soon!

There are days when the market is moody, finiky and frankly uncooperative. Those types of days are few and between and rather than hang around and be humbled or worse gratuitously give money back to the market…go do something.

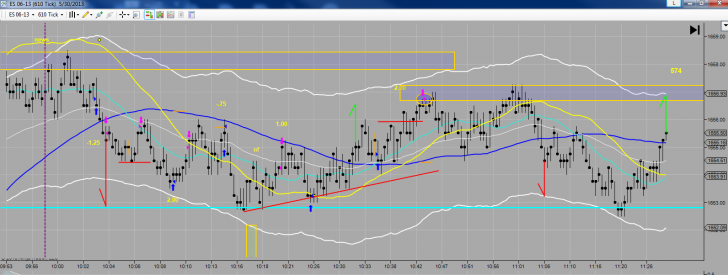

Today was not one of those days…in fact it was the opposite. The market had plenty of volatility (movement) and volume (plenty of participants). These are the ideal conditions…movement and strength = many rewarding opportunities.

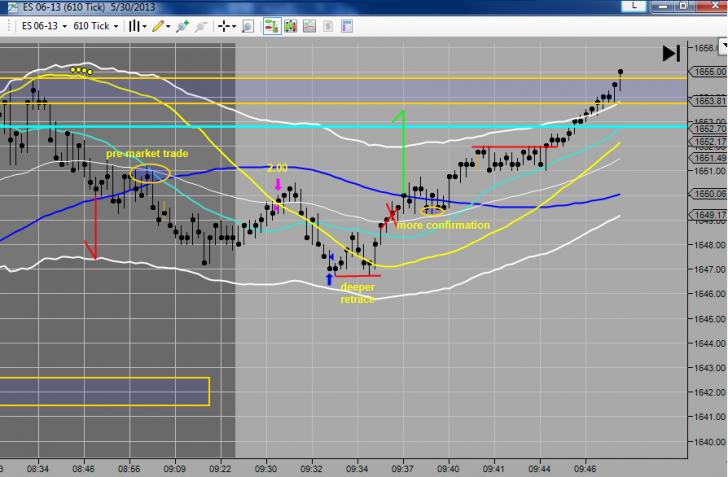

Right at the open, we had our first setup that went to 2 points right away. Most days I would be done and headed to do something more interesting with my free time. But today why rush…let’s take advantage of the movement.

I passed on the next long since I was anticipating a deeper retrace and never got the slow down I was expecting….I also passed on the next long since again I wanted to see a more compelling run in order to participate. A good lesson worth mentioning here is that once I make a decision, in this case pass on a trade, I really don’t care what happens with the trade.

My job is to make the best decision based on the information available to me at the time and not second-guess myself. The reason that I don’t second guess myself is that since I consistently make the same decisions under the same circumstances I have placed the probabilities to my advantage and that is the key……..maintaining my edge in the market. In my experience, these trades have a higher failure level than success…so why would I treat this trade any different from what I know to be true?

(click on chart for larger chart)

After the news, we had a nice high probability trade set up. This trade failed quickly and there was little to no room to adjust the risk. Again not all trades work and this is a trade I would take every day and twice on Sunday…..I need to keep making consistent decisions.

The momentum switch immediately offered a short opportunity, followed by a small loss by managing risk. After the new low, I went in again and this time I left the stop alone, gave it some room to work out, and got out at my target to the tick.

Momentum to the downside quickly waned and the market quickly reversed and I went with the momentum…..nice trade to the upside……in and out at 2 points and that’s all she wrote. 6 trades, 4 wins 2 loses for a total of 5 points. Not bad for 72 minutes of work.

I’m hungry…grilling time!

Click here to see the complete list of Market Recaps