Welcome back to Medellin, Colombia! One of my favorite cities in the world I have decided to spend my Christmas holidays in Venezuela and would be heading in that direction tomorrow. We can certainly see the changes in the market as we approach the holidays. There has been a significant increase in erratic behavior as the direction of the global economy is becoming increasingly uncertain and there is less and less participants in the market. Its very interesting to watch.

I have my hands full with all of the coaching that I am doing and have also received great feedback from all of the new and seasoned traders that are helping me develop the program. What I have decided to do since Im not able to take on any more students is let you start trading for $1,000. It will be a completely self paced course, click here to learn more. Its my Christmas gift to you. Sign up below for updates on the coaching and other updates Im making with the site:

As we get deeper into the holidays I plan on watching the market instead of trading it. I have found in previous years that the last 2 weeks of December and first week or two in January are very poor for day trading. This year may be different since we have so much volatility and volume.

Dec 12th started off very well. There was a great run to downside and I took my 1st trade and didn’t work out. The volume trigger saved me from the first deep pullback but I didn’t get lucky twice. Because of the strong trend to the downside, I decided to re-enter this trade with what we are now calling the Momentum Override Switch. It’s one of the concepts that I am trying to teach my traders of how to read the market and take advantage of its movement without being restricted by a set of rules.

Click here to see some results & income statements from us

Once I saw the strong run down I immediately knew that this was going to be a runner. I left my 5 pt target in place and soon enough I heard the magical voice from Ninja Trader say “target filled. T2 is a spitting image of T1 with the exact same results. You can see how the market is a bit more erratic and how it isn’t respecting our areas as much so far this morning. The way around that is to take advantage of what the market gives us.

T1 & T2 were good for a total of 10 points

T4 was a picture perfect trade as well that I was able to to take advantage of but unfortunately, the strong down trend ended here. The market started to consolidate which means we simply have to wait for more opportunities. With the strong trend to the downside, we want to make sure that we have a convincing move back in the opposite direction. Its like the boy that cried wolf, except we are waiting for him to cry bloody murder before we take longs.

I didn’t take any longs for that simple reason and you can see that one may have worked out for roughly 1.5 points. We know that these trades are very low probability which is why we avoid them all together. There is no reason that we should try and make a point or two when in the long run we will have more losses with those types of trades than winners.

T5 is a more aggressive trade but since it coincides with the overall down trend I decided to get in and get right out. At this point, we really don’t know if the market is going to continue going sideways or if the market is going to continue down. T6 answered that question with a hefty 5 tick loss. No Christmas presents, sorry. Once the market retraced I took T7, knowing still, that the market had a great change to continue to the downside.

Notice how the market came back and retested the resistance and also how there were lower highs and lower lows as well. That was the signal to get in. What we didn’t know is whether this was going to be a simple 2 point trade or a runner. I decided to watch it closely and I placed the notes on my chart so you can see when and where I decided to move my order.

Its another thing that I am teaching the traders in my training program, the ability to read the markets activity in both a micro and macro level to extract the most you can out of the market. I didn’t get filled on the edge once the market hit my 5 point target and with such a strong move I decided to go for it:

NASA, we have a runner.

I normally don’t do this but when your grandmother keeps giving you more food even when your stuffed you keep eating don’t you? Same premise here, if the market is going to continue to run in one direction I might as well be in the market rather than out. All I did was tighten up my stop behind the price and let her run until she came back and stopped me out (red line is my stop). Why is the market always female by the way? Why can’t it be a man?

The market tries to trick us once again by moving back to the upside. Knowing better, I waiting for the market to head back down and too my last trade of the day, T8, which worked out well for about a point.

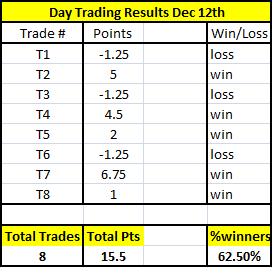

- Total of 8 trades

- 3 losers

- 3 big wins

- 62.50% win ratio

Click here to see the complete list of Market Recaps

Nicely done! Interesting trading day.

So are you still going forward with the $1000 training program?

If so, I’m interested in joining up.