It is my pleasure to present the managed accounts team at The Day Trading Academy. Over the course of the last year we have been creating and developing our day trading centers around the world.

For those of you that are new to the site you may not know about our new Colombian Trading Center.

We recently hosted our first MTU, Military Training University, where we were trading live alongside many of our student traders.

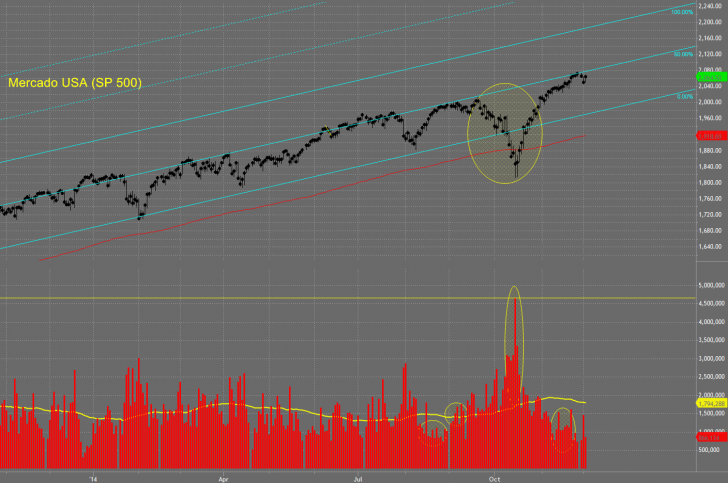

Luckily we were trading during one of the most volatile and highest volume weeks since 2011.

One of the beauties about being able to day trade is the ability to make money when the market is going up, but make a fortune when the market is going down.

It was an amazing event where are student traders were able to trade alongside many of our Master Traders.

There was a huge improvement with all of our student traders because of the one on one time that we were able to give them. Everyone traded between 9.30 to 11am, our Master Traders making over 70 points for the week with under 15 trades, and our student traders showing great improvement.

Our Day Trading Center in Colombia officially lost it’s virginity.

Speaking of virginity, two members of our Managed Accounts Team our just graduated from university.

We met them a few months ago and soon found out they were graduating with degrees in financial engineering.

Intriguing.

We are opening our day trading centers around the world in order to find in house traders and they are a perfect fit.

Our training program, after all, is designed to improve our own trading. By continuing to adapt to the market we are able to stay ahead of the curve and continue to extract (much enjoyed) profits from the market.

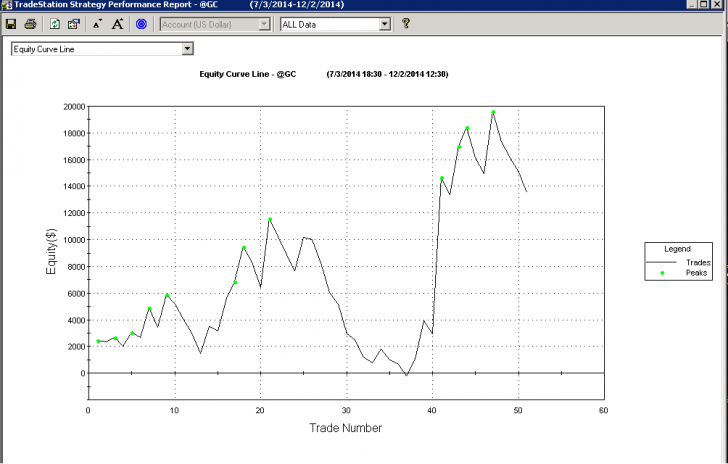

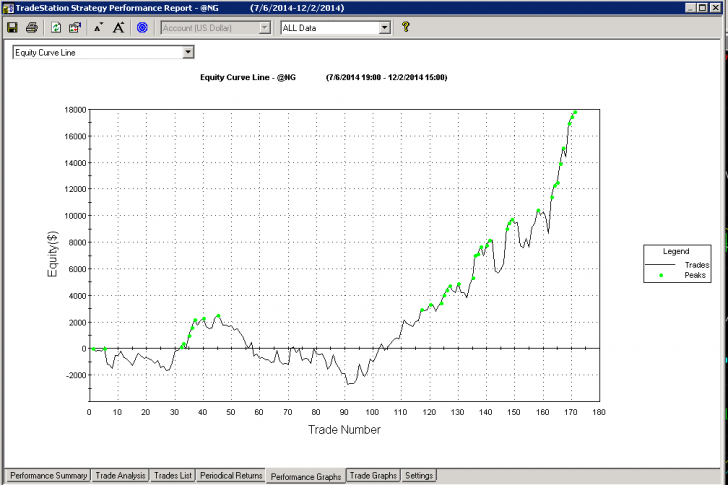

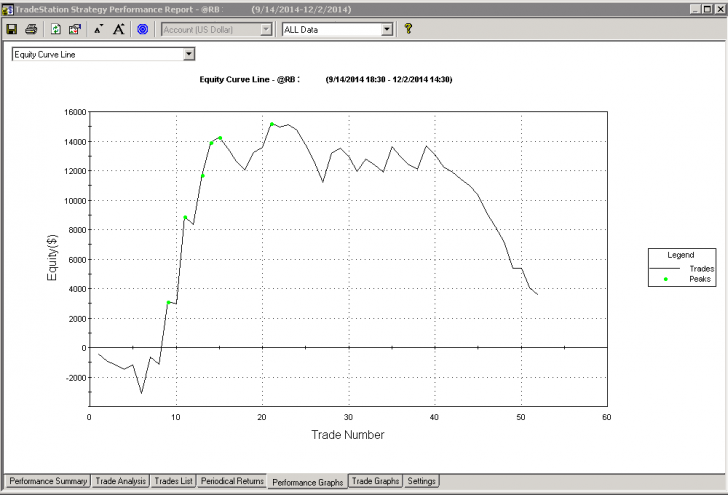

These two traders went live on July 13th of this year and here are just some of their results (equity curves from Tradestation). As of today with their open live positions they are up roughly 23.5% on their accounts. Annualized that would be roughly 62.75%.

Gold Positions

Natural Gas Positions

,Gasoline Futures Positions (Open trade with PnL of $7,681.80 in profits)

They have been doing exceptionally well. As we continue to grow our base of in house traders we are starting to apply the same strategies to other markets around the world. This is both to diversify and also to see the viability of making even better profits in local markets.

We have secretly launched our investment newsletter to a handful of our own traders and insiders and have seen great success. We plan on on launching that publicly shortly to be able to make solid returns in both stocks as well as.

Here is the video, watch it on YouTube if you have in any trouble (10 mins)

Also… don’t forget to sign up for a live trading event tomorrow where you can have a look at how we look at the market. The key is to be able to understand how the market works. This way, we don’t have to rely on company’s for software or indicators. Look forward to seeing you tomorrow! Just click here to join us tomorrow at http://daytradingacademy.com/webinar

U never mention anything abt the margin accouts..

Margin accounts in the futures industry is much different than margins in stocks. Not necessary to mention it.