How To Trade Around News Releases. Methods Every Trader Should Know

Trading around news releases is extremely important due to the risk involved in market movement responses. The reactions to news are often unexpected and can be extremely erratic. This alone is the primary reason why we want to avoid trading around news releases altogether.

Let me share a story, an insight from a trader:

There was a time roughly 7 or 8 years ago when there was an extremely successful trader. This was a friend of a friend who was based out of London. He was making his gains in the market like any other day. Up very big on a position he forgot about a news report that was being released.

Chaos ensued. The markets spiked. He ended up losing $1 million on that trade. These are the bad news.

Although he lost $1 million on his position due to news there is still good news. He was still positive after that catastrophe. Just $1 million instead of $2 million however.

While he still made a profit that day he learned his lesson to never trade around news releases ever again. There was a point when our traders developed a strategy around news releases, specifically the FOMC report. We always try to test new trades and develop new techniques. This can be very powerful as markets continue to change and adapt. Another reason we use our successful students and graduate master traders to assist in trade and strategy development.

Due to the significant movement and behavior during the 2001 and 2008 crises there were opportunities to make money trading around the news because of the increased volatility. Eventually we decided on the side of caution as it is extremely risky to trade around news as these levels returned to normal.

Everyone in the training program at the Day Trading Academy is advised to not trade around news releases. There are simple techniques to identify when news releases are coming out. It is also important to have the capacity to understand market movement. This is why we don’t wait a certain amount of time after news reports to resume trading as most traders do. More on that below.

You do know that you should that you should adjust your trade management during the options expiration week correct?

We plan on continuing these new trader insights weekly. Stay tuned next week for information on how to trade options expiration week.

Day Trading News Calendar Websites:

There are two major news websites that one may use in order to verify the time and date of news releases. They are Forex Factory and NASDAQ, see the links below.

At one point we used the NASDAQ but now we primarily use the Forex Factory website. Forex Factory is preferred as they continue to adjust impact levels based on market reactions and fluctuations. This implies that they will alter the importance of news reports as time goes on.

This is significant as the market will react to different news reports at different periods in time. One may remember the time when the oil inventory report significantly moved the market. This was just a few years ago during the 2008 crisis and Iran debacle.

During today’s market conditions though we have nearly zero reaction to oil inventories.

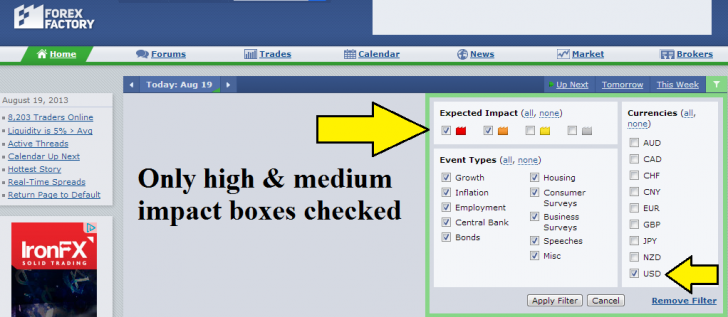

Understanding these changes we only pay attention to what Forex Factory considers high impact (red icon) and medium impact (orange icon) items. We only stop trading high impact items with red icons.

Since most of us trade the United States stock market indices we filter news reports by only United States news and US dollars.

“How to setup the new releases for day trading”

Once adjusted the news list will automatically filter all United States news as well as high and medium impact news reports. This is what a typical day looks like with news:

“The Forex Factory news calender”

How To Avoid Day Trading News Releases

As long as we are outside of a 5 minute window we will continue to look for high probability opportunities. Once the 5 minutes limit is reached we will stop looking for trades. In other words, we do not enter any trades once we arrive at 5 minute to news.

If already in a trade one may continue to manage the trade effectively until we arrive at 1/2 minutes before news. It’s recommended to exit a few minutes before news in case the reports come out early.

Exceptions to the Rule: Chicago PMI

The only exceptions to this rule are the FOMC report and the Chicago PMI.

The Chicago PMI currently impacts the market significantly. This is the only news item where it does not matter if we have either high impact or medium impact listed. We always stop trading for the Chicago PMI report no matter what.

It is also important to understand that the Chicago PMI is released early to insiders. Since you and I are not big wigs we should avoid trading in and around 10 to 15 minutes before the Chicago PMI is released. The Chicago PMI is often listed between 945 and 10 AM Eastern standard Time. Stop entering trades roughly 10 to 15 minutes before news and exit all positions between 8/12 minutes before news.

The FOMC Report

The FOMC report and minutes were never as important as they are now. It seems as though the day trading and global investing world are fixated upon the very thought of the decisions made by the federal operating market committee (the Fed).

Quantitative easing and the Ben Bernank’s decisions significantly impact the market direction. We have talked about this in depth via our posts on the decline of the US dollar and how the unimaginable deb will impact the value of the US dollar.

FOMC days can be a tossup. We leave it to the individual trader to decide whether he will trade or not. If there is going to be good activity it usually only lasts for the early morning session, an hour or two. We always assume 200 trading days since we have days like these were some traders may not trade at all.

Notes on Day Trading around News Releases

Speakers do not cause erratic market behavior. Since they are discussing a subject the market will generally move but not spike. It’s important to understand that we do not stop trading for any speakers, even the Ben Bernank, even if it is listed as a high impact item.

Any governmental organization meetings such as G7, G20, or any other ridiculous group that starts with the alphabetical letter is treated the same. We do not stop trading for any meetings whether it is listed as high or medium impact.

Other Useful Links:

Just wanted to say that this is a great addition to your site

Thanks for all your time

ED

Yes, I agree with my fellow Ed.

Great infos-

Thanks for that great work and the kindness of sharing your secrets with us.

ForexFactory.com is great!

Thank you for your help.

Thank you for your generosity.

Our pleasure Benito

you are really expert , i wanna see a lot of video of yours thats what i want to learn

Thanks fore sharing this info,

Hey Marcello, thanks for the insights on trading news. It seems meetings are not as important as I thought…

My pleasure Charles

Thank you for your video. Short but useful 😀

I’m mostly waiting for ECB (super mario !) datas but I’ll keep an eye on some others now 🙂

Excellent info Marcello.. saving us “retail traders” many ticks.. Comment: there are more “subscription” reports (yes, you too can get early info for a measly 100 to 200k per year).. than Chicago CPI.. Michigan consumer sentiment for one.. and there is incredibly suspicious price movement right before others.. many weeks (not always) there are massive whipsaws in GC and NG, that happen a few seconds before the exact time!

Question: Do you think that adding..”be prepared to exit quickly” to your.. “it’s okay to trade when Fed Chairman is speaking? I agree with your “move the market” comments, although probably since you made this video, there can be extreme price reactions when “quantitative easing” comments are made.. especially the time Yellen gave the impressiom interest rates would be rising much sooner.

We never stop trading for anyone that is speaking Jack so adding to a position is fine. The reason why is because there aren’t market spikes. The market may move in a certain direction significantly but we can still read the market when that happens. We cannot read the market when there are erratic spikes (ie: news reports).

I find that trading the mini SP future market at important support and resistance levels is less risky. Important news reports makes market fluctuate but it mostly stays with those levels unless the news is extremely bullish or bearish which can make the market move in that direction considerably!

Trading with the trend Sam will always be less risky than trying to trade support and resistance areas.

Hey Marcello,

Some time news release helped me.. Recently soya oil and palm oil declined on the basis of news releasing….China sell 1 million tonnes soya oil in the market and soya oil show flops… Also palm oil uses decline in biodiesel… Palm oil also declining..

Great insight Marcello. But Forex Factory is not the only site around that delivers great info and categorized news events like this…

Is it me or does the video posted has no audio? Tried two different browsers and pc’s … same results. No audio even on youtube’s direct site.

Weird Ralph.. could try to have a stereo output on your computer. Audio is fine on our side.

It is a great information, but please is really important do it in spanish too, please , any way congratulations I am very thankful for your sharing

man i wanted always to learn trading but i never went in to searching how to learn.but now that i had a heart surgery my live change i can´t pursued my carreer no more so i was breking my head of what to do with my live how to go on because every one to have a good life so i was thinking what to do where to start with a new carreer because i´m only 27 so trading got tru my mind i went looking on youtube how to trade and bam marcello your video comes up i´m watching and start to ged interrested and i sayd i got to learn how to become a day trader.marcello man thank you for strarting the DTA may god bless you and the accademy and may all you wisshes come tru.i´m looking forward to get more training by you gay´s and tips and learn how to trade,í´m looking foward to start trading simulatedly

Hi

I thought that the meetings, the G7, G20 were very important…thanks for the information

Wonderful insights on news trading Marcello, thanks for the wonderful job you are doing. please keep it up

Thanks Abdul

Great video!

Cant wait to start in DTA

🙂