This recap is from one of our Graduate Master Trader. Students that have graduated from the program and are trading live consistently.

Today’s lesson is to trust your instincts. May 17th is independence day for the Norwegians, so I hunkered down into a library to avoid the pre-day festivities taking place in my apartment building.

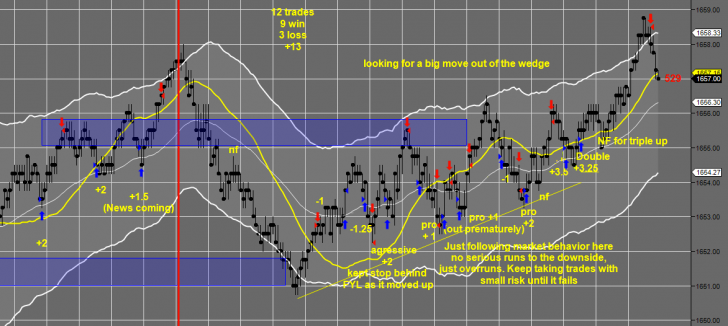

The early morning (before news at 10) was relatively straight forward.

Maybe the 3rd trade was a little aggressive because we had news coming in 12 minutes or so, and I was still in the second trade.

However, I like to double up if we have good momentum and I was not going to be worried by the possible area forming, at least not at this point.

After the news sent the market down I took a couple of conservative trades that failed. At this point, I noticed today was starting to look a little like yesterday.

We began to trend to the upside, and although we were getting overruns of the midband, the market was not continuing down. The trade at about 10:31 was my trade of the day. Although it was only a 1 point pro trade, it was confirmation for me that I was correct about my analysis of the market.

At this point it was all systems go to the upside, until the market showed me it was going down.

The pro trades are NOT valid conservative trades that are in our normal curriculum (we use DTA’s HTS management system to start off), but I was taking them on reversal bars with my stop 1 or 2 ticks behind the edge.

You can see the entry at 10:31, but it’s important to note that I did not give these trades the normal 5 tick stop.

I immediately moved my stop up behind the edge to 1652.25 which only gave me 3 ticks of risk. This is my usual strategy for the pro trades, and I continued this on all of the pro trades to the upside.

We talk in class about wedge formations, which is the process where a trend converges with a support or resistance area. I’m a visual learner, so if you’re like me take a look at this example.

We expect the market to explode out of a wedge, one way or the other. The resistance area we were trading into had been respected pretty much all day. I say pretty much because we had a small breakout right before news at 10.

HOWEVER, we do have a trend up and the market was not giving us any continuations down. We finally did get the explosion to the upside and I exited right at the slowdown, I just wish I would have been filled on the triple up!

I think this is an invaluable learning experience because many times traders are so caught up in areas, that they lose sight of what is really going on in the market.

While I did take some pro trades I would highly recommend traders to not try to take pro trades until Marcello Arrambide (CEO and Founder of DTA) thinks you are ready. The point of this is not about the trades that I took, more about letting go of the fear!

Let go of that fear and trust your instincts!

Click here to see the complete list of Market Recaps

beautiful trading. and it’s all about the fear. still working on getting over mine!!!!!

Great job in reading the market and using the pro trades.

Thirteen points is pretty amazing.

Motivating stuff! I assume this is the infamous trading of Jim Steele? Or is it agressive Nikolai?

Would love to see more charts posted of this trader. Not necessarily to reach the same profit number, but the analysis provides a lot of insight on how to read the market.

Neither of the two my man will be sharing who this is shortly

I remember donating my money that day.