After almost 10 days with internet speeds of the era of the Roman Empire I have finally secured a great connection here in Toliara, Madagascar. I’m currently using a Wi-Fi connection at the Bo’s Restaurant, if you are ever in Tolaira make sure to order the Zebo Steak, it’s excellent. Later I realized the reason why this is the only decent connection in the country, the main underwater fiber optic sea cable connects to Madagascar via Toliara.

If you are interested in Day Trading in Africa check out my post on why it’s about to get a lot better.

Today’s trading was exceptional and I was excited to get back into it since I had zero internet for roughly 10 days. Madagascar is one of the poorest countries in the world and getting to many of the tourist attractions in the country require a 4X4. If you are interested in going to Madagascar check out my travel blog about my experience in the country.

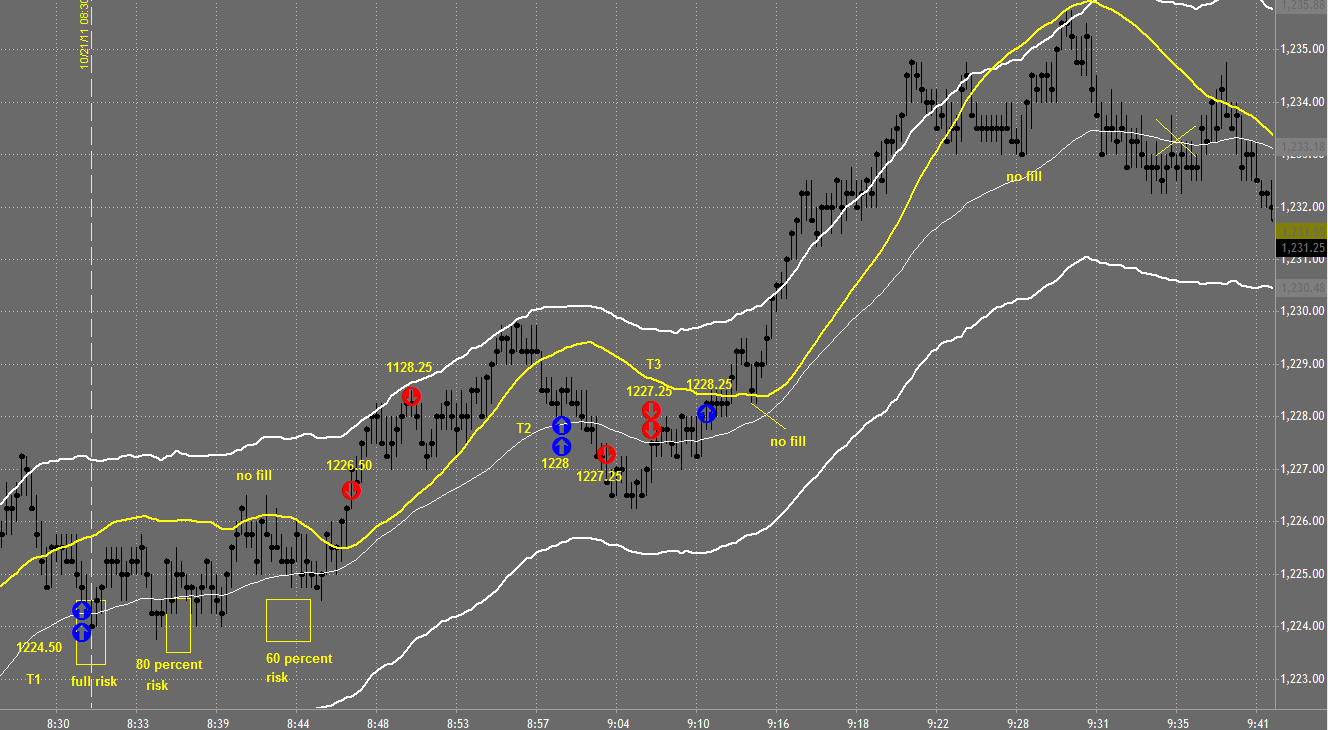

Click on charts to enlarge

There is a great lesson to learn in today’s trading with trades labeled T1, T4, T5, and T6 (especially T1 & T6). You shouldn’t move your stop until the trade has moved sufficiently in the direction of the trade. There is a balance when trying to minimize risk and maximizing your reward. If you move your stop too early, you will get stopped out, if you don’t move the stop quick enough, you won’t be able to extract the most amount of ticks on that trade.

Notice how I managed T1, the full stop was left in place until the market moved and established a new area of support. After the market moved up again the stopped was decreased to 60%, or 3 ticks. At this point I am really able distract myself by trying to order dinner in my broken French.

The waitress understood Zebo but didn’t understand steak. Either way, when you have such little risk on the table you have tremendous amount confidence in the trade. The momentum did slow down but the expectation was still up.

I had an initial 2 pt target on this trade that didn’t get filled which I split into two targets since my new target area changed of the 1128 area of resistance. Another great lesson can be found in T2 & T3, you need to know when to get out. I managed to only lose 3 ticks on T2 and 1 point on T3 instead of 5 ticks on each. I saved $37.5 per contract that I was trading,

this waitress is definitely getting a tip!

Two no fills as I anticipated the market to go up and one trade at 9.34am that I didn’t take because of the momentum to the upside. There has been an uptrend in the market since 11.19 yesterday, I tried to take a short at T3 that failed, at this point I need to see the market drop to my shoe laces before I take a short.

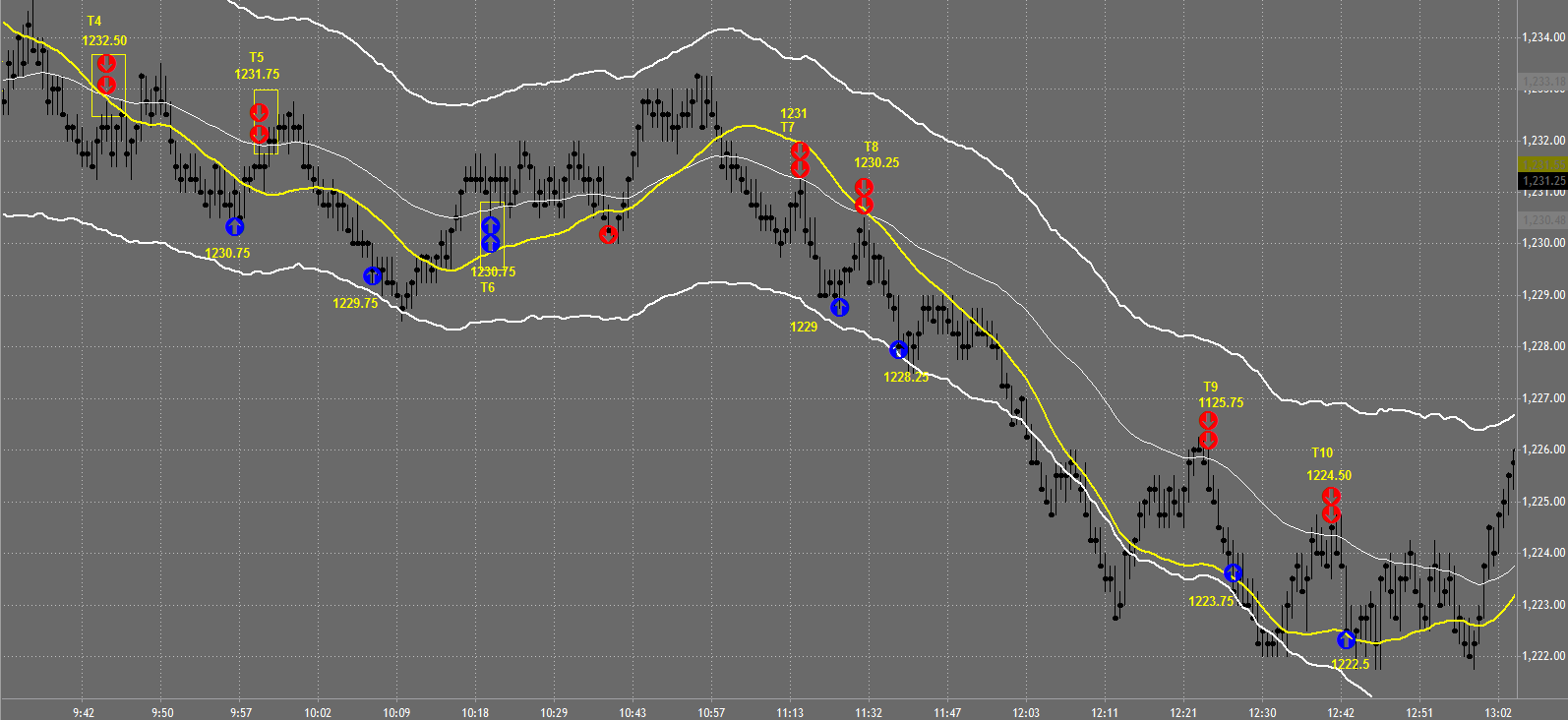

We received that confirmation at 9.42 after the market respected the area of resistance at 1235 and T4 & T5 worked out perfectly. You can see that if I got nervous and moved my stop I would have been stopped out of both trades.

Give your trades a chance to work!

Once we get to T6 I realized that the small downtrend could have easily been a retracement for the overall trend up. I made the right decision here but was unlucky as I got low ticked at 1230, you win some you lose some, the waitress is still getting a tip. The market fails to continue the uptrend and we have a strong move back down just before T7. T7 and T8 were picture perfect trades and it looks like I missed out on a massive move to the downside.

Controlling your emotions and “wishing” that you would have caught that move will be detrimental to your trading. I still was able to capture 4 points on both T9 and T10 which is more than enough for just one day’s trading. Overall I am pleased with the day, I was unlucky three times but due to my good decisions on other trades it balanced out and I came out on top with roughly 12 points.

As I write this I am preparing for my trip to Ethiopia and Somaliland. The hotel I have booked in Ethiopia has internet but the country is notorious for having horrible internet, I don’t know anything about the internet in Somaliland and I have a feeling I will be more worried about not getting kidnapped than day trading.

On unusual thing from today’s trading that you will notice is that I traded all the way to 1pm. I generally don’t trade this long but I kind of missed trading. One of the characteristics of top traders is that they don’t look at the market and try to make X number of dollars or points. They just try to win, today was all about winning. Look out for a post coming out about characteristics of top day traders.

Click here to see the complete list of Market Recaps

Thanks for the post Marcello. You touched on the thing that kills my trading more than anything which is moving stops too close too soon to try and lock in a profit. Then, as price moves against me I get stopped out with a tick or two profit instead of allowing the price to hit my target. I seem to be right in a large percentage of my trades but I panic too quickly and take small profits off the table rather than let the price hit my target. If a person takes a full stop out of 1.25 or 1.5 points but only gets an average of a 1 or 2 tick profit due to moving a trailing stop too soon the account will eventually be at zero. Your explanation helped. Trading is much more of an art than a science. Thanks again.

Anytime Aaron 🙂