Welcome to Livingston Zambia! What do you think about my day trading office in Zambia? The internet at this cafe is really pushing the boundaries for the required internet speeds for day trading.

There are days when I start looking at what’s going on in the pre-market. While today was not one of those days, looking at what happened between 9.00am and 9.30am I really wish it was. I could have been done at 9.45am today and could have explored the city of Livingston, Zambia a bit. I arrived at the Kilimanjaro Cafe in Livingston, Zambia at roughly 9.15am. In the morning I was jumping into the Devil’s Pool at the Victoria Falls and also taking the terrifying Gorge Swing. I would highly recommend that you visit the country of Zambia:

Zambians are some of the most genuine people that I have met in Africa

T1 is a picture perfect trade, a massive down run from 8.51 to 9.32 set up this trade beautifully. This is the kind of trade that I would take with my eyes closed. I hesitated because I was distracted by the laptop power cord, I unfortunately have a laptop that can power NASA and when it isn’t plugged in it dies in about an hour. I exited for a quick two points which coincided with some support areas.

The entry on T2 was perfect, right on the edge at 1157. This doesn’t happen all the time and to be honest it takes a bit of luck to get filled on the edge, some skill as well but mostly luck. In order to get filled on the edge you have get your order in before everyone else. If there are 20 people ahead of you then you may not get filled on the edge. There is no way to elbow and push your way in front of the line like a South American soccer game, it’s more of a western system where you wait your turn.

The early bird gets the worm

With the massive move down I was anticipating a continuation so I split my target at 2 pts and the 5pt maximum. T3 is in accordance with the momentum down as well but since we were on the opposite side of areas I decided to get out right away with my 2 pt target. I tried to take a trade at 9.59 but here I was pushed out of the line, the market hit my fill price roughly 3 times and I didn’t get filled.

I really wish I could use my elbows in the stock market, always worked for me when I played soccer in high school (I kid, I kid). Market runs up I take T4 with the consideration that this may be just a deep retracement for the move down. I hesitated for a split second and you can see how fast the market can move.

A massive bar down signals that this is indeed only a retracement for the move down and I hit close with a 1 tick loss. The market then consolidates and I wait for a break out. T5 isn’t considered a breakout but since the market is still in an overall down trend I decided to go for it with the strength of the move down. My target on the matrix was 1151.75 but in my mind I was extremely curious to see if the market would reach 1150. If it wasn’t for this hamburger that I just ordered I think I may have split the target just to see if it would have made it.

T6 & T7 are picture perfect trades. I didn’t use a 2 pt target for T6 because there were more areas that coincided with the outer band instead of just the 2 pts, I also considered the fact that we just broke out of the consolidation and would likely get a bounce up. T7 I stuck with the 2 pt target simply because at 11am I was ready to stop trading.

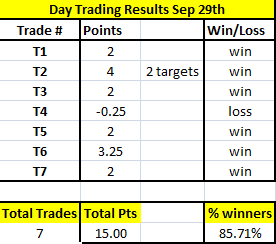

Day Trading Results for Sep 29th

- Total of 7 trades

- 6 winning trades

- 1 losing trade

- 1 trade didn’t get filled

Marcello, Hi my name is chris and i have been following your travels for a little while and am interested in learning to trade. I myself have traveled extensively, just got back from London,Paris and parts of italy spain greece and turkey.

I am a registered nurse in los angeles and am ready to transition to a mobile lifestyle.. minus the nursing!! can you please help point me in the right direction for training, and any advice would greatly be appreciated.

thanks again Marcello,

Chris Phebus

Hey Chris, great to hear you are a fellow traveler. I will be putting up a ton of free resources here on the site if you want to have a look around. I’ll be launching something probably by the end of this year so definitely stay tuned for that

Hi Marcello,

I was wondering if you could clarify something from this post…

You make a comment above that says :

” This doesn’t happen all the time and to be honest it takes a bit of luck to get filled on the edge, some skill as well but mostly luck. ”

My question: Do you enter on a Limit order or do you use market orders ? and how do you determine where to place your entry ? Midband ?

Thanks

kevin