If there is one thing that I enjoy more than making money on a Friday before a weekend is going out and paying for a lunch that costs $3 right after. I’ve gotten settled in my home in Medellin, Colombia. By settled I mean my book bag and clothes are still thrown on the bed and floor because I would rather spend my time looking at charts than taking care of important things like putting things in their place and getting organized. Only thing I need in this world is my laptop and some day trading charts.

If you think that’s funny I’d like to share my day trading office from my recent trip to the coffee region. If you would like to give me a moment I just realized I need to find my camera first.

I went with a group of professional photographers so I had the pleasure of trading from a small table inside of a photo studio in a city called Armenia, Colombia. I did ask my self why I get myself into these kinds of situations but the internet in Colombia is exceptional and I was able to watch the market here and there which is all that I need. I was even able to tether my blackberry and watch the market while on the road. We visited many small pueblos that didn’t have internet, imagine me trading off my blackberry. I think it is amazing how far technology has gone.

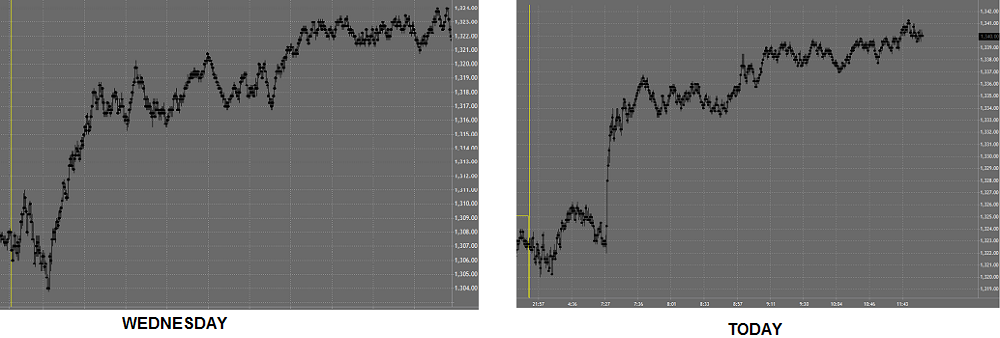

The market today started off eerily similar to Wednesday which looked a little funny in the pre-market. A massive spike to upside in the premarket and then the market just flat lined. To me this is very unusual because the market never shows so much strength and quick movement without a reaction. I’m not talking about the actual type of the move, I’m focusing on the movement of the bars and when we have that spike there is a lot of decision and strength and then afterwards there was erratic behavior and indecision.

It’s normal to see consolidation in the market after a move like that but the market acting like it has indecision? That’s not normal.

The plan for today was to be cautious simply because we may have some erratic behavior in the market. The spike up today can be attributed to the extremely good unemployment numbers which aren’t exactly accurate. I think that may be why there was indecision today because people realized that those numbers being put out by the government are bogus.

The numbers included in the report do not include people that have dropped out of the labor force, in other words, people that have stopped looking for jobs aren’t included in the unemployment report. There was 1.2 million people that dropped out of the labor force. Click here to read more here.

Convenient isn’t it?

I’ll be honest and share that I didn’t look that up before I started trading today simply because news doesn’t matter. Its all about technical analysis with the E-mini S&P 500, I only found that information after the fact when I was curious to see what happened.

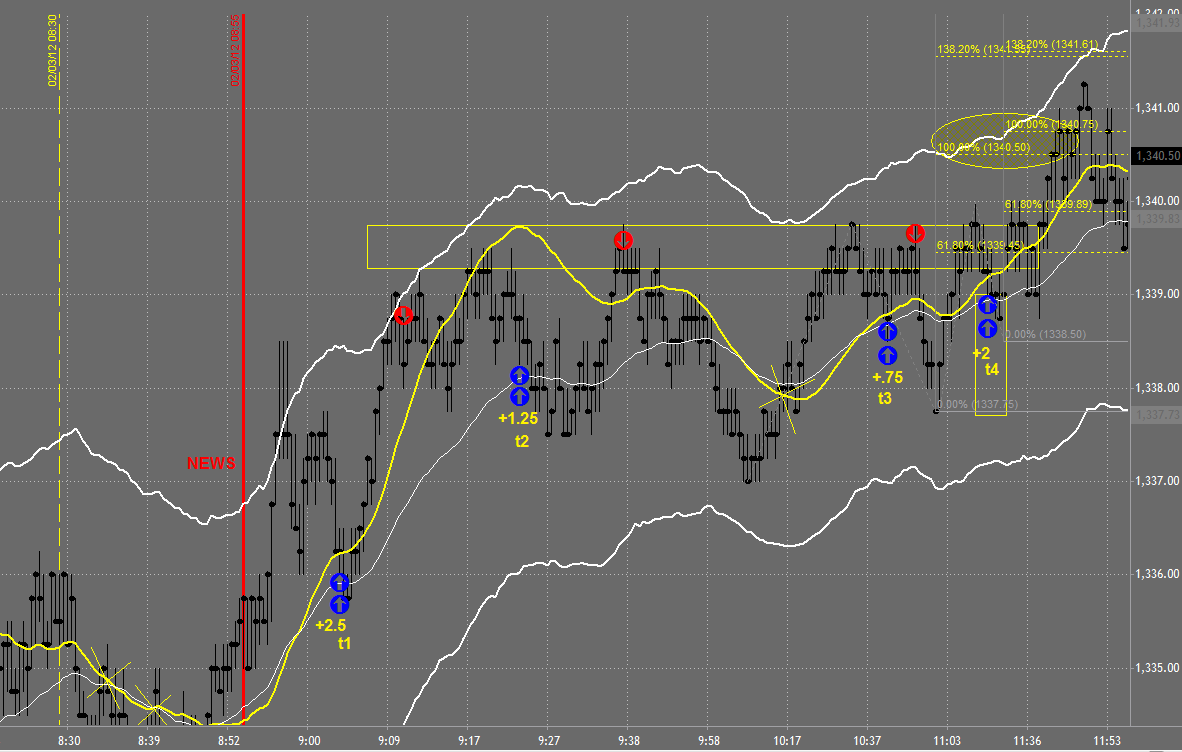

When the day started off I didn’t take any shorts because there weren’t any convincing moves to the downside. The market was just grinding downwards so I decided to wait until I saw some strength in the market. Once the news report at 10am came out that really moved the market and I was ready to rock and roll. I was in T1 and the market immediately popped to the upside. I thought for a moment “maybe this is what the market needed to start moving”. I saw the pop adjusted, my target, and came out with 2.5 points.

I was a little upset because I could have made 3 points on that if I didn’t get greedy. I normally would just get out with at least half my position and instead I got greedy and looked for the big move. 1st lesson in day trading: DONT GET GREEDY.

I placed my target right at the edge for Trade #2 at 1339.50. I wasn’t going to play the breakout but I was going to maximize my position and get the most out of it. Normally, I would have my target waiting at a tick below the edge and once the market wasn’t filling my order I hit close. What happened? I got greedy again and missed out on another two ticks. That is a full point already that I missed out in the market all because I decided to be greedy.

After this move up, I wasn’t going to take any shorts until the market showed me 150% that we were heading to the downside. I wasn’t going to be fooled into taking any shorts until the market proved to me that we were really heading to the downside. It’s like the little snacks they give you for free at the food court in a mall. The food you eat never ends up being as good.

No meals for me sir!

The next trade T3 is the type of trade that if I am going to take, I know going in that its going to either pop or I’m getting out right away. Most traders won’t touch this trade but I know that I have a very high probability of the trade working, the question is how far will it go? I’d say it’s close to 90% the chances of this trade working, don’t take my word for it as I don’t have concrete numbers. I have seen this too many times not to take this trade. I was out quickly with three ticks and T4 is lesson of the day. A very important lesson at that.

I drew the risk vs reward boxes to give everyone a better idea of the thoughts that run through my head in these situations. When I’m going to get into a trade I consider where the trade can go.

I drew the risk vs reward boxes to give everyone a better idea of the thoughts that run through my head in these situations. When I’m going to get into a trade I consider where the trade can go.

At the time of entry, the only place that I know the trade is going is into the area of resistance which is roughly 3 ticks to a point away. Many people ask me:

Why take a trade if its only for 3 ticks or 1 point?

The answer is because of probabilities. If I have an over 70% chance of winning this trade and I can make (lets say a point) an average of 1 point while only risking 2 or 3 ticks, those are pretty good odds. In 200 trading days a year imagine how many points that can add up to.

I took the trade the red box is my initial risk and the blue box is my potential reward, keyword potential. Once the market moved up I had a decision to make, hold for more or get out. With the market making a new high and higher lows I decided to hold it.

The runs to the upside are getting larger and the retracements to the downside are getting smaller and smaller. A fancy wall street trader would tell you that’s a wedge, a 27 year old unorganized day trader that puts machetes in his mouth in the middle of the coffee region in Colombia would tell you I like my odds to the upside. I minimized my risk to 3 ticks and now my risk vs reward looks much better, I am now only risking $37.50 to make at least $50 to $100.

Well… that is my rant for the day. I’m going to go fetch my three dollar lunch which is a nice plate of chicken and veggies at a local restaurant here in Colombia. Have a great weekend everyone! Happy Trading.

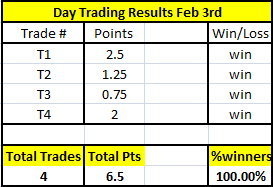

Results for February 3rd

- Total of 4 trades

- 100% winners

- Missed out on 1 pt (bad mgmt)

Click here to see the complete list of Market Recaps

Love your stuff. Could you tell me what kind of bars those are on your charts? I’ve seen videos on Youtube of others

trading a screen that looks similar to the one above but with a macdbb (whatever that is) indicator on the bottom of the chart.

Keith… they are high low close bars on NinjaTrader