Im back from the coffee region and I haven’t been able to trade because my email inbox has been absolutely massive. I recently became a partner with NinjaTrader to run the indicators that use with them and I had an explosion of emails about how I day trade and travel. A big shout out to NinjaTrader for accepting me as a partner and for everyone that has asked how my recent trip to the coffee region was, here is a picture that explains it all! Because of all the emails I have decided to open up three spots for the training program. I currently have one spot left so just shoot me an email or contact me if you are interested.

Today is the reason that I day trade in the market. I only have to day trade a few days every month but I usually trade much more than that since I have such a passion for it. For those of you that love to travel I would highly recommend that you visit the coffee region in Colombia so you can have a machete in your mouth in the middle of a banana plantation. Seriously.

On to the good stuff!

I started the day with my typical two point target and 5 tick loss. With my day trading strategy, I make sure that I always win more than I lose and that my winners are larger than my losers. In the odd event where I don’t feel well and I am off of my game then I know that I have the edge in the market which is very important. My goal everyday is not to try to make money, its just to end up on top. At this point in my near 10 year trading career I only pay attention to the number at the end of my trading day. If its positive that’s what matters, its about winning because if I can win every day then I know that I can make money.

It always irks me when I lose the first trade of the day. I don’t know what it is but its like getting up and having a bad hair day, it just doesn’t feel right. I didn’t lost much on the trade being that it was only 2 ticks, I personally would be willing to lose $25 on any trade that I take. The market quickly turned back to the upside and I had a great trade in T2. While I was holding my 2nd trade I tried to get filled on a third with no luck. I only double up on trades when the market is moving really well which I saw in the beginning of the day today. I exited my 2nd trade and I decided to skip the next area (marked with an X).

The market slowed down quite a bit and I didn’t like how the market was showing a slowdown. Afterwards, it ended up being a great decision and the market rocketed back to the downside for a nice trend back to the overall support area at 1318. I had my original target for T3 but once I saw the movement in the market once I saw the pop I immediately reported to Houston:

We Have A Runner!

I moved my target and instead of having it hit my target I exited on a slowdown. T4 I decided to keep a 3 point target as I noticed the market was giving us 2-4 points runs, I minimized my risk and was ready to hold through a deeper retracement if necessary. My target was filled and I tried to get into another trade but the market didn’t fill my order. I was looking for the market to reach the overall area of support that I have highlighted with the box. The market the rockets off the support area and since we had a strong pop I decided no matter how good the trade looked I’m not going to take it. Especially since the market has really respected our areas this week.

The final trade of the day took me past my 1pm est trading limit and as the market slowed down I was filled for two points. It was a great day to be in the market and I’m glad that my first day back from the coffee region started off with such a bang!

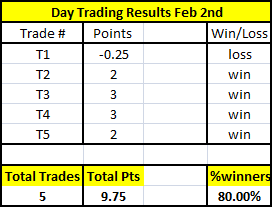

February 2nd Results

- Total of 5 trades

- 80% win ratio

- Total of 9.75 points

Click here to see the complete list of Market Recaps