The official Ninja Trader Brokerage Reviews will be coming shortly with time as the new acquisition has been completed. Ninja Trader, one of the best charting platforms on the market, has acquired Mirus Futures, another market leading company in the E-mini futures brokerage industry.

This is incredible news since Ninja Trader is now able to offer everything in house. What stands out with the new Ninja Trader Brokerage is the commission structure. The new brokerage is now offering the lowest commissions in the industry.

High five for Ninja Trader anyone?

The commissions are now lower than any other brokerage in the industry. Before, a trader had to trade a significant amount of volume to receive these lower rates. Now they are being offered to the market on a mass scale with just one catch.

You have to own the Ninja Trader platform.

It is a brilliant strategy by Ninja Trader and the new Ninja Trader brokerage. It is also great for traders because it benefits the entire industry as a whole.

Traders will now be able to save upwards of $2,000 to $3,000 just on commissions alone in the first year of trading.

Read our official review of Ninja Trader vs Tradestation here

Watch the video below for the full description of the new changes that Ninja Trader is offering. You can also watch the Ninja Trader brokerage review on YouTube if you have any problems with the video below.

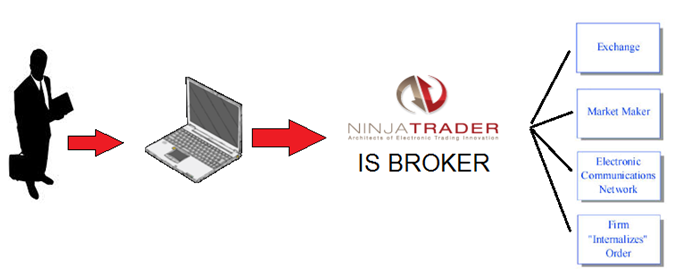

There are a few moving pieces when it comes to a trader putting orders in the market. A trader places an order on his/her computer via an order entry platform. In this circumstance, Ninja Trader. Normally we have to enter an order into Ninja Trader which then is routed through a broker to the exchange.

One of the great things about how we trade at The Day Trading Academy is that we don’t have to worry about High Frequency Trading because we place limit orders. This means that we tell the market at what price we want to get filled. That is a story for another day.

The broker is the company that routes the orders to the exchange and completes and connects everything that has to do with the order.

There are only a handful of companies that provide an all in one experience. One of them being Tradestation which has offered this all in one services for years now.

Now Ninja Trader has become the broker which eliminates a significant portion of moving pieces. They are able to streamline the process since they are now the platform and the broker. They are able to save all of us money because they employ economies of scale.

Another high five for Ninja Trader

The route they have taken is to offer extremely discounted commissions in order to get more business for their Ninja Trader platform. They have also expanded into Brazil with by announcing an agreement with a local brokerage firm (to be able to trade the Brazilian Bovespa.

We definitely have been in contact with this new broker as we are looking to apply our high probability trading concepts to the local markets of Brazil.

The New Ninja Trader Brokerage

The data feed providers have been consolidating in recent years. There are now only a handful of data feed providers. With Ninja Trader becoming a full in house company they may be able to provide a data feed in the future.

In the meantime one can choose from; Zen-Fire, Trading Technologies, CQG, and even Continuum (which is powered by CQG). CQG seems to be the most popular option to shove down the throats of traders. We phrase it this way because most brokers have given us no choice. Although there has been known issues with CQG most options are now CQG or the CQG powered Continuum.

Tradestation also provides its own feed but that is one of the disadvantages of the platform.

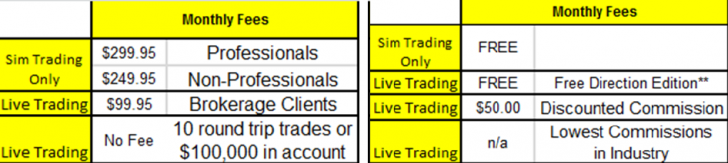

Here are the monthly fees Tradestation and Ninja Trader. Take note that Ninja Trader does offer a 100% FREE live trading platform now. In the past one needed to purchase Ninja Trader in order to trade live. Now one can trade live with the Ninja Trader without paying for the platform.

The commission structure is also extremely aggressive and will surely cause a big stir in the industry. Most brokerages want to start traders in the $4.20 range. There is a charge per side which means that we are charged when we enter a trade and when we exit a trade.

To put the costs of trades into perspective here is how the costs are broken down. Fees may vary for different exchanges but as most of us trade the E-mini S&P 500 we will provide that below.

E-mini S&P 500

- Exchange Fee – $1.14

- NFA Fee – $0.02

- Total per side – $1.16

Every time we enter into a position we are charged $1.16 by the exchange and The Feds. When we exit that same position we are charged $1.16 again.

This is the cost “per side”. The total charge is known as the “round turn” which is $2.32.

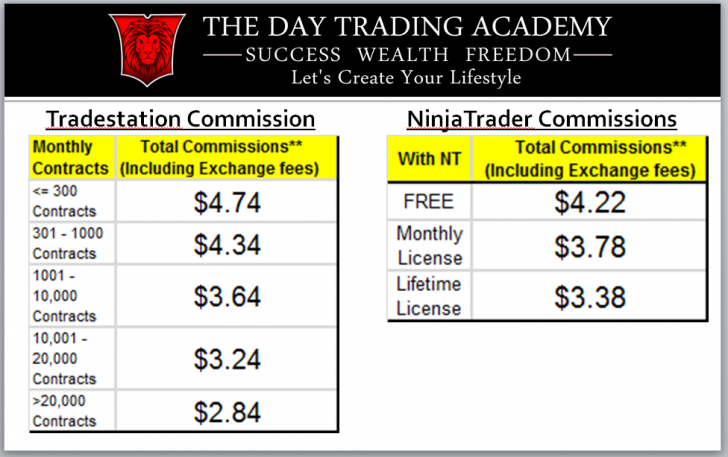

Anything above that is profit for the brokerage. Anything above $4 would be ludicrous to pay in our opinion. The average for the industry would be in the $3.60 to $3.90 range. You can see below how astronomically high Tradestation charges for its commissions.

Here are the comparisons with the new Nina Trader Brokerage commissions:

Ninja Trader Brokerage commissions compared to Tradestation commissions

One can see that the new Ninja Trader Brokerage commissions are extremely low. Trader’s wouldn’t have been able to obtain those rates until they were trading a significant amount of volume. Since Ninja Trader makes money off its trading platform they can afford to offer the lower commissions.

The new business model for Ninja Trader is all about obtaining more clientele for their charting platform.

The new approach will allow them to continue to make money once someone purchases their platform. It is very similar to how Microsoft began to market and manufacture its own tablet after Apple completely dominated the industry with its Ipad.

Remember that Microsoft never used to make its own products before. They only supplied the software.

This benefits most traders as we will now be able pay (much) less for our charting platform and now get commissions that are the most competitive in the industry.

Even after paying the one time $995 fee we will save THOUSANDS on commissions.

Ninja Trader was already our choice when we compared just the charting platforms. Remember that Ninja Trader before did not have its own brokerage firm.

Just assuming placing orders with one contract, 5 trades per day, and 20 trading days a month, Ninja Trader would already save a trader $924. A trader would recover his investment in 1 year. Keep in mind there are 245 trading days a year.

The standards of service that Mirus Futures has provided over the years should cross over into the new Ninja Trader Brokerage as well. In full disclosure there has been some issues with the data feed (Continuum) since the beginning of the year. We do suspect those issues will be solved as Ninja Trader is now behind both the brokerage and the charting platform.

Look for updates on the new Ninja Trader Brokerage firm and also the new Ninja Trader 8.0 release soon.

Stay profitable my friend.

Stay profitable

I am concerned with Data Feed by Continuum or Rithmic vs Tradestation. The chart pattern is very different. Whats up with that? The TS seems to be more accurate displaying Open Close High and Low. Take for example DAILY ES current contract on TS and compare it to Continuum on NT 24/7. You will see a two very different chart patterns with very different Highs Lows and Open Closes. Can any real future trader comment on that? So fat to me it seems like TS displays a more accurate and real data vs to filtered Continuum or Rithmic. So I have an additional expense in Kinetick data feed for NT. I have seen all sorts of comparisons between the TS and NT. But I can never find a good professional review on a Data feed providers particularly TS vs Continuum and Rithmic.

Rob… TS provides bundled data while NT is unbundled. This may change after MDP 3.0 takes place I would wait until November or December to see how things unravel. All of our traders operate on NT and just because it appears a bit different does not mean that TS is better. We compare these things regularly and for the most part, overall, NT is a better platform to use.