We are on the tail and of our trip traveling and day trading in India.

We recently to word through the entire land of the Kings, Rajasthan, and have continued through the holy city of Varanasi.

One may realize keeping up with our India travel blog over at WanderingTrader.com that we had an excellent confrontation with the Indian Mafia.

The holy city of one of the most populous countries in the world is something else to experience.

Holy Man in Varanasi India

There is a lesson to be learned on this trip once a certain level of success has been reached and a trading. We invited Marcello Arrambide‘s, our CEO and founder, mother to India in order to experience one of the most unique cultures on earth.

Always do something nice for your mother when you start trading consistently

After visiting the city of Varanasi for roughly a week we have now arrived in the ancient city of Khajuraho. The city is known for its three complexes of ancient temples that were built around 950 1050. Many of the temples have been destroyed and roughly 20 remain throughout the city.

Onward to the January results…

Trading Mom with a holy man in India

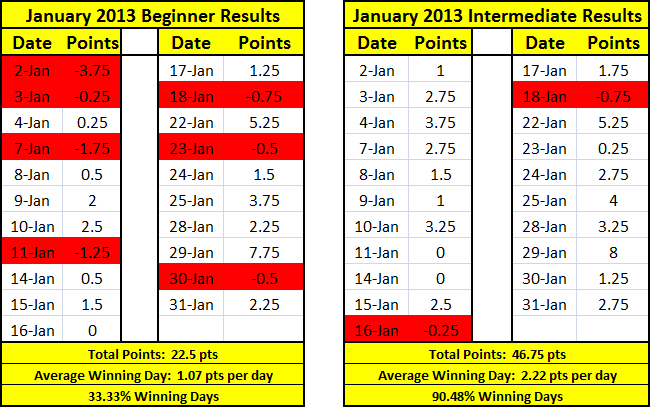

In addition to continually adjusting the parameters for the Congressive Trading System we decided to make a few changes in the way we keep results for 2013. Initially we only kept track of the beginner results which do not include any risk management or profit maximization.

With the lowest volume on record in September we decided to start keeping track of the intermediate results which included risk management.

This netted a great increase in profits.

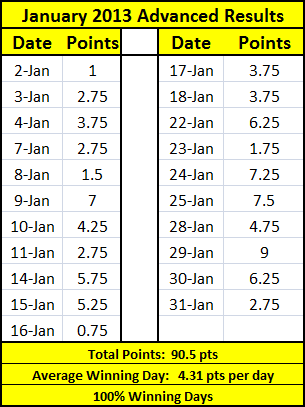

As we continue to graduate successful students from the training program we have found that there is a need to continue developing new trades and advanced training techniques. We now have the beginning of what will be our advanced and intermediate curriculums in addition to our restricted pros room.

Our method of transport in India: The Tuk Tuk

The pros room will house all of the advanced trade setups that are not in the normal curriculum. These additional trades can add significant amount of profits to our bottom line.

We have even seen some traders understand market structure so deeply that they begin to take only certain legacy trades (trades that are in our basic curriculum). They start to reach consistency by taking the Pro trade setups.

We have tried to keep the results of the trading strategy very objective with specific trade rules for trades, set profit targets, and no risk management. When we start to analyze advanced and pros trades they are based more on momentum them they are rules. This is one of the basis of how we trade by understanding market structure rather than paying attention to indicators.

The new advanced results will include the advanced trades which we often discuss in our live market classes.

We can attest that the pro results are in line with the results that we have seen from our graduate master traders and in-house Pro traders.

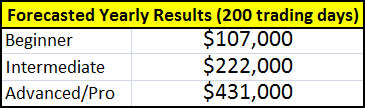

One of the impressive statistics that we have seen is that once we start to incorporate risk management profits rise roughly 150%. In the table above one may see we are actually had an 200% increase in profits.

This is one of the reasons why risk management is so important in day trading

it is more important to not lose money then it is to make money. Another interesting statistic for January is that the beginner results only had a 33% win ratio. The monthly average is slightly lower than the cumulative 2 points a day figure.

One would have been second-guessing himself by the middle of January. Most of the profits and the beginner results came in the second half of the month. Typically in the beginning of January we do see lower volume due to the holiday season.

We always assume 200 trading days a year when in actuality there are 245 trading days a year. Most traders like to take the end of the year off in addition to the beginning of the year.

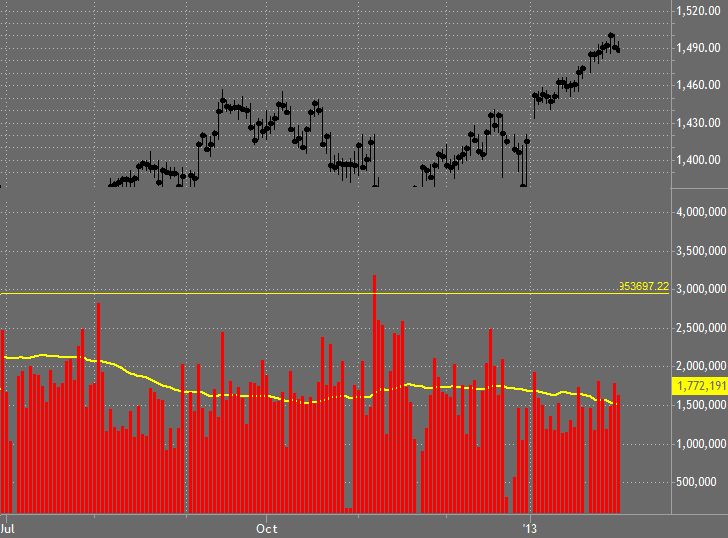

One may see the lower volume in the chart below:

The results get much more exciting once we start to look at the advanced and Pro trade setups. We placed to restrictions on the advanced results in order to achieve more conservative results.

Profit targets are lower than normal for both the advanced and Pro trade in addition to the regular legacy trades (normal trade setups).

Even with those restrictions placed one may see the potential of what an advanced and Pro trader is capable of achieving.

Even with those restrictions placed one may see the potential of what an advanced and Pro trader is capable of achieving.

Click here to see a chart of how one of our traders dominated the market last Thursday.

We plan on sharing more trades of our graduate master traders as we begin to open our day trading centers around the world.

It is going to be extremely exciting to chronicle how we are going to train local traders in emerging economies such as Colombia, Brazil, and even India.

Many of you asked us how much this would relate to on a yearly basis.

We always assume 10 contracts to stay consistent and that is a number that every trader stripes for. Once reached, many traders trade 10 contracts for quite some time.

One may see the variation in results and what is possible. One of the reasons we focus on consistency is because a trader just needs a small amount of profit every day in order to make a living day trading. The key is making a profit every day. Don’t forget to peruse our disclaimer & disclosure on the footer of this page about the results listed on this site.

Stay profitable my friends….