Br Dr. Z:

Every day is going to be different. Every morning has a new story to tell and different variables to give you those hints.

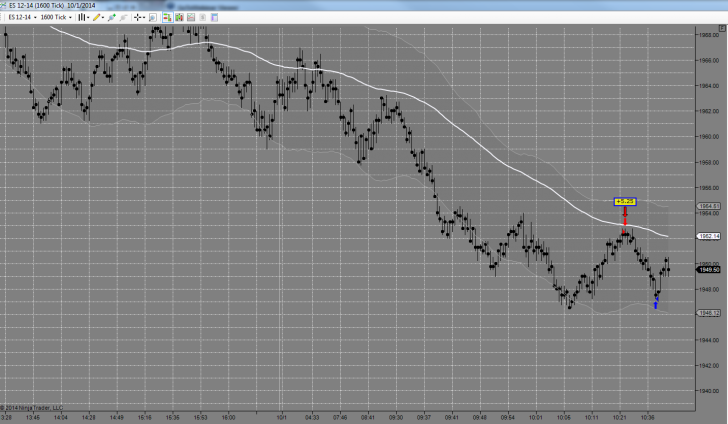

The market has been ranging sideways from the big move down last week.

Because of the strength of the channel I wanted to be careful with the pop down as sometimes the market will FOBO (fake out break out) or gravitate back to those strong areas.

When I saw the move break away with momentum down I was looking for the next short.

My first trade was aggressive because of the momentum of the market and I used the momentum to look for a conservative extended profit. When the market hit a possible area and failed to make a continuation I backed off and just sat on my hands to see how it was going to react.

I knew the behavior was not appropriate for the amount of momentum of the initial move and even if the buyers were stepping in it would take a pretty strong reaction to reverse this momentum. News came out as the market was showing weakness for the buyers and I passed on a short opportunity to make sure no anomalies would high tick me after the news spike.

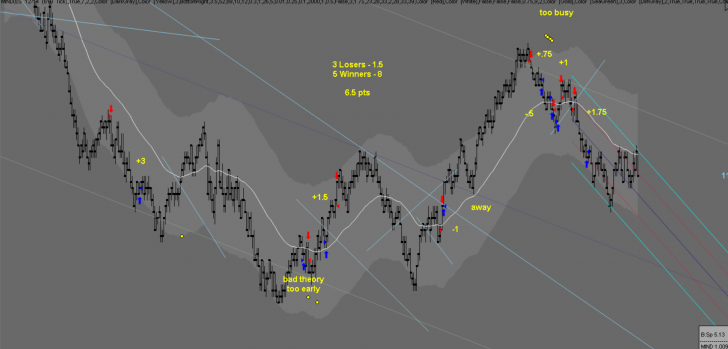

The market had a lack of continuation again rebounding off the area again confirming its significance. I exited an early long as it was too aggressive for the position and waited for confirmation. With a reaction of the higher lower I took a conservative profit and just sat back again. When the move failed back to the downside I looked for an aggressive short opportunity to scalp another move after it failed but it was the pivot point for the market to reverse and was stopped out for 1 pt. From that point I stepped away and came back to see the move to the upside climb to the next area.

I took another pro short at the area and got out aggressively as it hit a possible edge for continuation and being the first move to the upside I didn’t want to misjudge the momentum. I had an expectation that the market was going to react off the area which was confirmed with the deeper retracement.

I exited my first long gracefully and took a deeper position at what I thought was the outside range of the move up. I scalped another long and waited for the position to show me more momentum to make a continuation and break through the area but when the move failed to break the initial pivot and pulled back for a deeper position I reversed my position and took a short to account for the failure in support of the trend line strength. I took it gracefully for 1.75 not sure how it was going to absorb the momentum of the move up and called it a day.

Here is another chart from a member of the DTA family, Point Dexter: