Day Trading For Financial Freedom

Day Trading is not only a unique, exciting venture; it can also be extremely profitable. What other profession offers the ability to double, or even triple, your income while working the same amount of hours.

If there’s one thing that we have learned about day trading, it’s that this is something that anyone can do. A college education or an understanding of stocks is not needed to begin and learn how to trade. We will provide you with all the information and support required to succeed.

Through our proven training programs, we have helped hundreds of students and members become consistently profitable traders, with many of them transitioning into full-time professional traders.

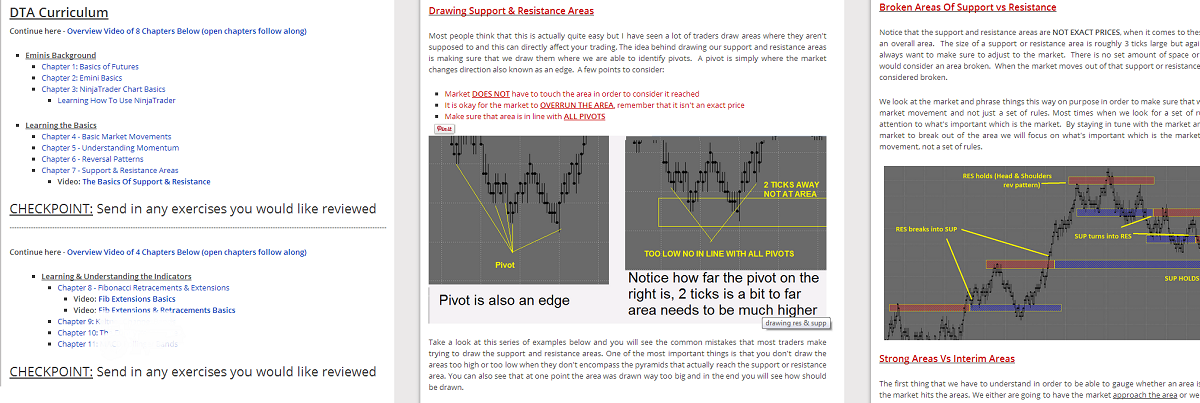

Before we discuss day trading strategies, we will review what day trading is, different methods of teaching, how to reduce the learning curve before going “live,” and what you should look for in a program based on your needs to be successful.

There are two types of people investing in the market; investors and day traders.

Investors are in the market for the long haul, often waiting years to make their money. This approach places retirement and savings into the market with the simple premise that the market will go up over time, thus netting a profit to the investor.

At the Day Trading Academy we trade E-Mini futures, which is an electronic index where people like you and I, can buy and sell small portions of major stock indexes. The E-mini S&P 500 has become the largest single traded market for day traders in the world.

We choose the ES for the following reasons: Great volume, Easy to learn & trade on, Hardly any erratic movement, Great for beginners/experts

We continue to specialize in the E-mini S&P500 because it consistently delivers results in any market environment. In other words, it is an easy market to adapt to and extract profits from. In addition to allowing the beginning trader to enter the market with a smaller position, many of our traders stay with the S&P 500 throughout their careers as contract load size can be increased, resulting in larger trades and profits.

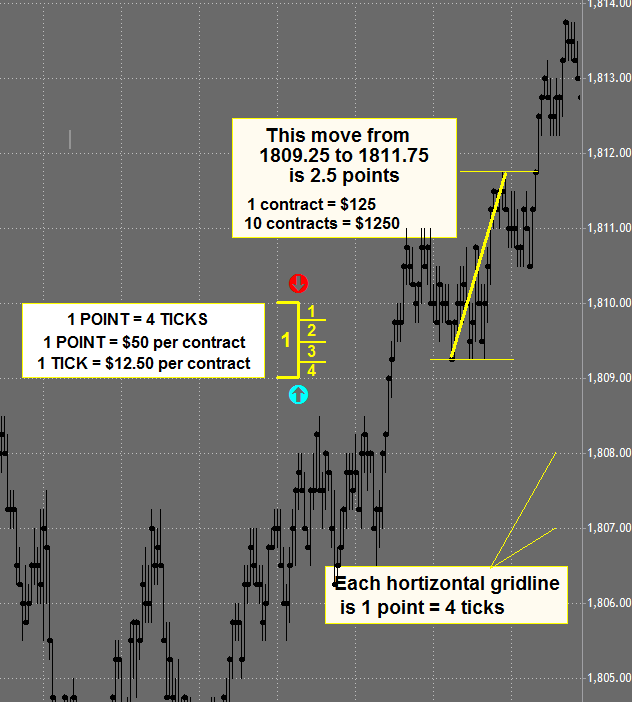

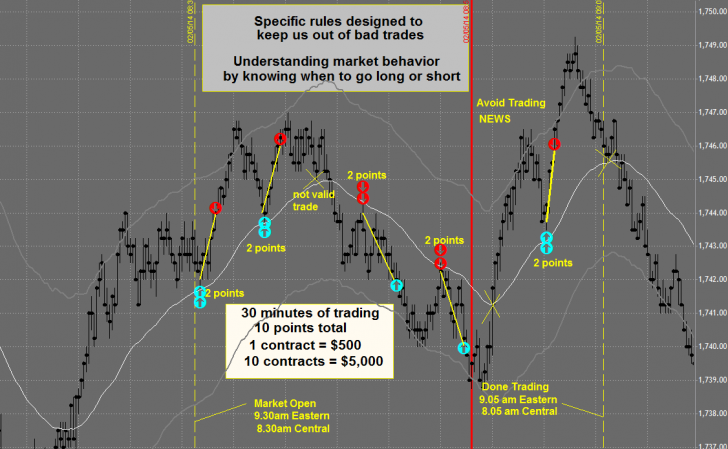

The principle of day trading is to make money off the fluctuations of the market. Whether it is rising or falling, we capitalize on movement. Typical trading time is an hour or two. When finished, our earnings are immediately available and where they belong; in our accounts.

Another reason we prefer futures over stocks is its return potential. With stocks, $1 is made for every $1 that the market moves (when you win). It sounds like a great investment right? You invest $1 and, if you made a good decision, you make your money back plus profit. Futures have a much higher profit potential than regular stocks, netting up to 10 times more money.

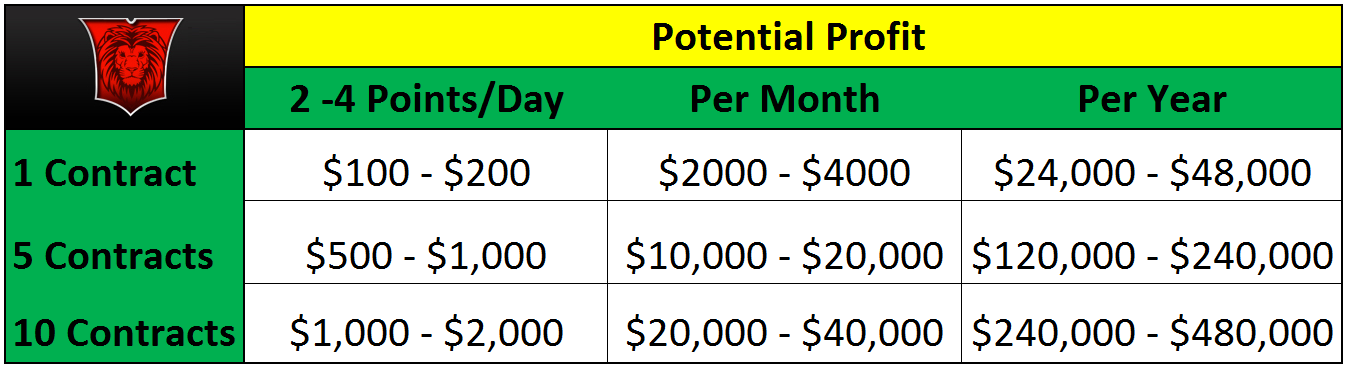

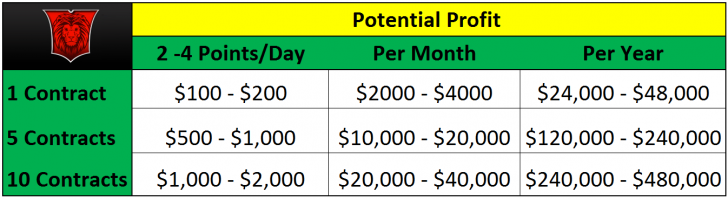

If we are able to consistently make 2 points a day, that equals $100 per day. When we increase our contracts to 10, for example, that turns the same trade into $1,000 per day. The E-mini S&P will allow hundreds of trades at one time. Not that it is necessary, but it gives an understanding of why our traders continue to trade this market after mastering it.

Day Traders Make Money When the Market Goes Up and When it Goes Down

As Day Traders, we are not required to follow the news and continually research a company’s fundamentals. We focus on technical analysis and momentum of stock prices to base our trade executions. Technical analysis uses a precise set of indicators, patterns, and movements that allow you to identify high probability opportunities in the market. It also allows you to gauge momentum, strength, and potential reversals in real-time. An active position for a day trader will last a few minutes to a few hours.

Getting started day trading isn’t complicated. Some say that it takes a lot of money, and others say only a specific type of person can day trade. We say anyone can begin to day trade, as long as you have the right tools to get started.

Here are the six things you need to get started day trading

* Computer/Laptop * Internet Connection * Charting Platform * Broker * Trading Strategy * Easy Market To Learn

One of the things we to do with all of our training program members is give them free access to the software they will be trading on, further reducing the capital needed to start. This allows everyone to enter the program without having to purchase a trading platform or open an account to “trade live” right away.

One of the things we to do with all of our training program members is give them free access to the software they will be trading on, further reducing the capital needed to start. This allows everyone to enter the program without having to purchase a trading platform or open an account to “trade live” right away.

The secret to day trading is consistency, and you will find that by reading the market the way it presents itself and not the way you hope to see it. By learning to read momentum, price action, and market theories, we set new traders up for success by giving them techniques for market analysis.

By focusing and understanding how the market works, instead of indicators and rules, we developed a complete set of trades that add a huge number to our bottom line.

To give some context, our beginner students (with NO prior experience) average around a 67.42% winning rate. Our Intermediate level students average around a 74.48% winning trades (reason being at this level, we teach an additional component of trade and risk management that allows us to win more and lose less), and our Advanced students average 77.63%+ winning trades with substantially smaller profit losses.

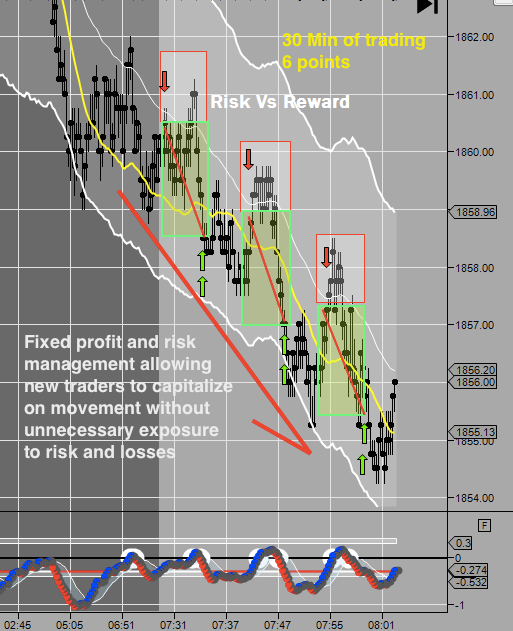

You can LOSE 61.74% of trades and still make money with the DTA method

How in the world is this possible? We know it sounds completely counter-intuitive, but it has to do with a very important element of trading: RISK vs. REWARD. This refers to the amount of money you are risking on a trade (if you lose) compared to the amount of money you set as a profit target (if you win). Through thousands of back tests for our legacy trades, we introduce new traders to a fixed profit target set-up that remains consistently profitable.

By keeping a simple chart, we can immediately assess how the market is performing and profit from the potential opportunities given to us. Our strategy uses a few indicators that help with volatility and momentum, but our main objective is to understand the market environment and adapt to its changes by reading live price.

———-

We are sure you may have more questions and need more information.

That’s why we have prepared Day Trading Guides that you can download for FREE with our compliments.

If you would like to be considered to join our DTA Training and Mentoring program and would like one of our Trader’s to give you a call anywhere in the world you are, please click here and fill out the form, and someone will contact you at your specified time and number.

Training Program openings are limited: If you want to learn more about program opportunities follow this link or call 1-800-654-6349 (USA). You may also enter your email to receive our free newsletter with exclusive events, such as live trading class invites and exclusive webinars.