When we are day trading we really have to keep the end goal in mind. The goal of trading is not to make a billion points everyday, the goal is to make money every day. Even if you made just 1 point every day in the emini markets you could still do very well for yourself. With the volatility that we have been seeing in the last in the last few months I have been used to make more than just a few points.

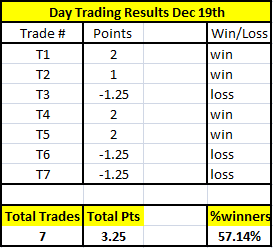

There was a conflict of feeling when I realized that I only had 57 win ratio. To be honest with you I don’t keep track of how many points I make because that isn’t whats important to me. What IS important to me is that I am winning more than I am losing (above 50% win ratio) and my winners are biggers than my losers.

My winners are always bigger than my losers thanks to my day trading strategy.

I counted the points and it was 3 points. I was upset but later I realized why I am upset for? I still made money today, good money at that, and that’s what counts. That is what should count when you consider your trading also, don’t think that you have to make 50 points everyday to make your dreams come true. I, my myself, am human.

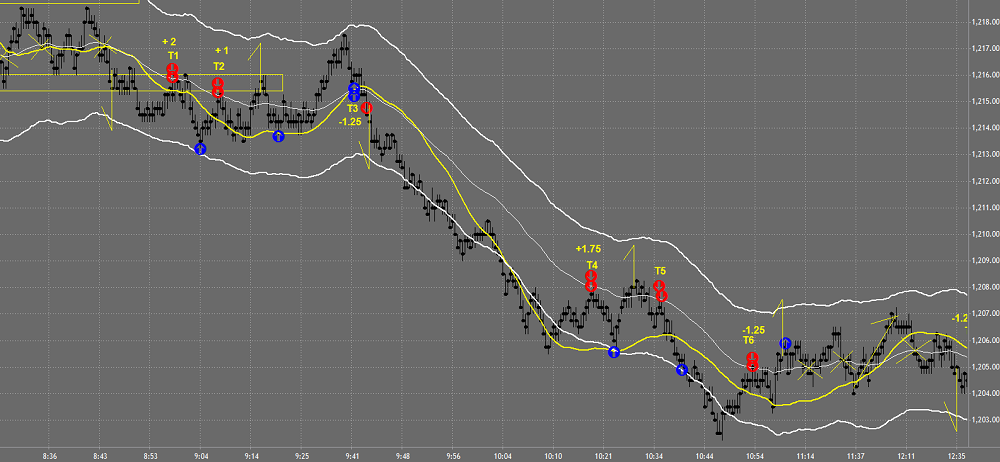

Click on the Chart to Maximize

The day started off with channel in the premarket which kept us out of the market right when the market opened. We eventually broke out to the downside and saw two great short opportunities. T1 worked out very well (hit my 2 pt target) and the T2 I had to exit early because the market wasn’t running to the downside. After that the market slowed down a bit we really wanted to see a strong move before we entered the market again.

We saw a great run up and a great trade as well that didn’t work out. After that the market took a strong swing to the downside and this is where I thought we were going to have some fun. This move resembled many of the strong moves that we have seen before a great trend sets up. T4 was picture perfect with 1.75 points.

I didn’t immediately re-enter because I didn’t like how the market popped off the area of support. Normally I have my order waiting when we have these kinds of strong moves but with the market giving us some erratic behavior this week I decided to be more conservative. We saw a deeper retracement, which wasn’t strong at all, and then a continuation back to the downside.

T5 doesn’t fit our trade criteria

But the reason why I took this trade was because of the Momentum Override Switch which I discussed in Dec 12th’s recap. When we understand the way the market works we can use that to our advantage to do make exceptions in certain situations. Could have made much more on T5 but 2 pts on any trade is enough for me.

The trend to the downside continues and I entered T6 which didn’t work out. It was still a good trade with the strong downtrend it just didn’t work out. You can’t see T7 on the right hand side of the chart but I will admit that this is not the best trade that I have taken but there are times that we take both good trades and bad trades. I wouldn’t go as far to say that this is a good trade, but it does fit the criteria for a valid trade.

- Total of 7 Trades

- 4 losers

- 3 winners