MACD BB’s used in day trading has been going on for a very long time. There are tons of variations of this indicator being used and no matter how you alter the basic indicator the MACD’s are used as a momentum indicator as well as a support and resistance indicator. It is one of the most basic indicators on the market and used by thousands of traders.

Using the MACD for Day Trading is not complex at all. MACD stands for moving average convergence divergence and I won’t get into all of the technical jargon as to why and how it works but I will tell you that it’s very effective when applied to day trading the correct way. This indicator is one of the primary aspects of my own day trading strategy.

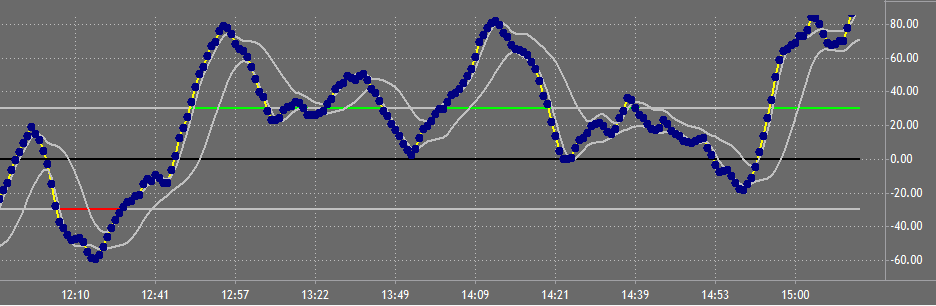

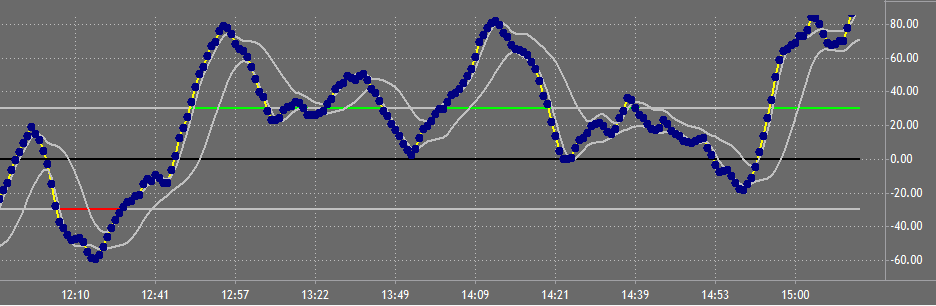

There are four different parts to a MACD indicator, there are the BB’s themselves, the zero line, and the bollinger bands. Since we think of the market as going up or down we can consider the momentum up when the MACD’s are above the zero line and vice versa when they are below the zero line. The farther the bands are from the zero line the stronger the market is in that direction.

The MACD indicator can also be correlated to the price of a certain stock or index in order to identify areas of weakness and even strength. There is a concept called divergence where there is a difference in movement between price and the MACD’s that can be very effective when combined with other day trading indicators.

I have been using the MACD indicator for close to ten years in my own day trading strategy. If you are interested in learning how to day trade just shoot me an email I’m always willing to talk to other traders about their own day trading or even if they want to get started.