Day Trading is a unique and exciting venture;

Day Trading is a unique and exciting venture;

A college education or an understanding of stocks is not needed to begin and learn how to trade. We will provide you with all the information and support.

We offer online programs to help you learn – without having to leave your home!

Curriculum

&

Videos Learn the concepts and theory online. Access to all our videos.

Learn the concepts and theory online. Access to all our videos.

Demo &

Virtual Classes

Virtual Classes

Guidance & Follow-up

Revision of your graphs and guidance in your learning process.

Revision of your graphs and guidance in your learning process.

Military Training

Intensive days of trading

Do you want to know more about our day trading programs, requirements and availabilities?

There are two types of people investing in the market; investors and speculators.

Investors are in the market for the long haul. This approach places retirement and savings into the market with the simple premise that the market will go up over time.

At Day Trading Academy we teach speculation in the E-Mini futures, which is an electronic index where speculators can buy and sell small portions of major stock indexes. The E-mini S&P 500 has become the largest single traded market for retail traders in the world.

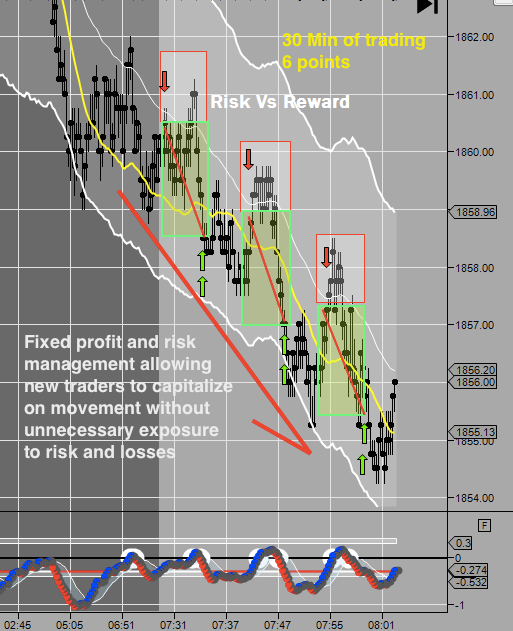

The principle of day trading is to try and make money off the fluctuations of the market. Whether it is rising or falling, we try to capitalize on movement. Typical trading time can range from an hour or two, potentially more for people with more time.

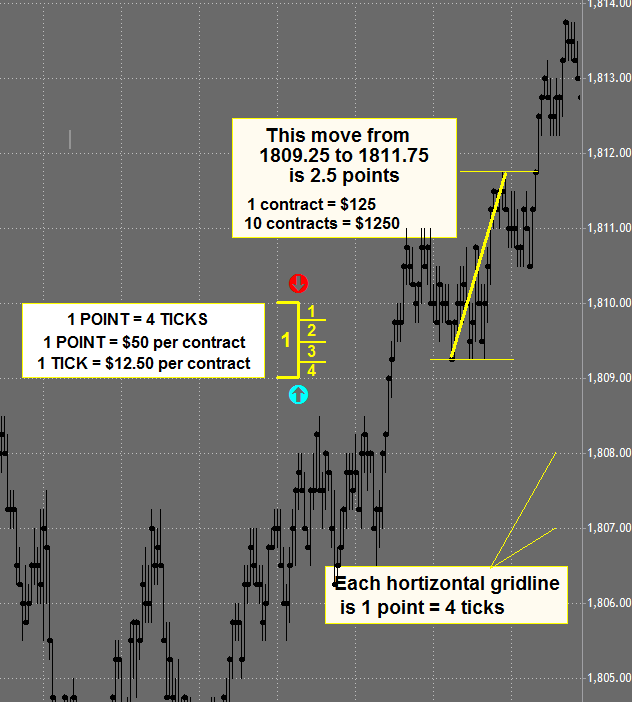

One reason we prefer futures over stocks is it allows us to use margin and leverage. With stocks, $1 is made or lost for every $1 that the market moves. Futures have a much higher profit/loss potential than regular stocks, due to margin and leverage.

If we are able to make two points on a given day, that amounts to $100 profit. When we increase our contracts to 10 for example, that turns the same trade into $1,000 profit. The E-mini S&P is what we call a very liquid market meaning it will allow hundreds of contracts to trade at one time.

We don’t care if the market goes up or down

As Day Traders, we are not required to follow the news and continually research a company’s fundamentals like stocks. We focus on technical analysis and momentum of price to base our trade executions. Technical analysis uses patterns, and movements that allow you to identify opportunities in the market. It also allows you to gauge momentum, strength, and potential reversals. An active position for a day trader will last a few minutes to a few hours.

Here are the six things you need to get started day trading

- Computer/Laptop

- Internet Connection

- Charting Platform

- Broker

- Trading Strategy

- Market To Learn

The secret to being successful at day trading is consistency. Traders find consistency by learning to understand the language of price. Reading the market the way it presents itself and not the way you hope to see it. By learning to read momentum and understand price action traders can realize and gain an edge.

You will and can have losing trades but still make money! We know it sounds completely counter-intuitive, but it has to do with a very important element of trading: RISK vs. REWARD. This refers to the amount of money you are risking on a trade (if you lose) compared to the amount of money you set as a profit target (if you win).

By keeping a simple chart, we can immediately assess how the market is performing and what potential opportunities are being given to us. Our strategy uses a few indicators that help with volatility and momentum, but our main objective is to understand the market environment and adapt to its changes by reading live price.

———-

We are sure you may have more questions.

That’s why we have prepared a Day Trading Guide that you can download for FREE.

If you would like to be considered for our Training program or learn more about program opportunities follow this link or call 1-800-645-6349 (USA).

You may also enter your email to receive our free newsletter with exclusive events, such as live trading class invites and exclusive webinars.