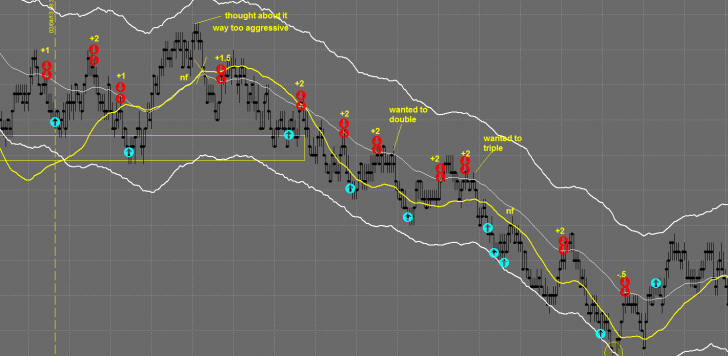

Don’t have enough time to do a full write up and video for the recap today but I wanted to share the chart. This is the primary thing that we try to do at the Day Trading Academy is to identify market movements and capitalize when the market is moving well.

There were two fundamental movements to identify today that indicated the trend to the downside was going to occur.

By being able to identify it we just ride the wave so to speak. Notice the last trade of the day is the only loser. Any other trade could have easily been a loser but I decided to let it work in order to keep taking the trade until the trend failed.

Its 2.40am here in India and I will be hopping on a flight back to civilization (NYC) at roughly 7am. Should be fun. Once in New York we will highlight a bit more about identifying these kinds of markets.

Stay profitable my friends

(Click on chart to make larger)

Marcello, what market is that? and why this one? Is it because of volume?

Its the ES Michael.. E-mini SP 500 futures market. I wouldn’t say volume I would say that it was extremely good movement.

Hi Marcello,

How many contracts do you trade at a time? And how come you don’t trade TF? It makes fantastic moves in the first 90min of opening.

Goodluck and best trading wishes:)

F.

Hey Fred! Great to hear from you… I actually started trading on the TF but when it switched exchanges we switched to the ES. The ES is an excellent moving market and generally provides great opportunities. It is the single largest traded market in the world and we have found that the TF and the ES generally have similar movements. I generally trade 10-50 contracts at a time but sometimes trade 100. I have gone higher but its quite different when you trading such a high contract load.

Do you ever have trouble getting filled with 50-100 contracts of ES? Any slippage? I know with the TF, anything more than 10-20 contracts becomes difficult to get filled.

Your blog is proving to be very inspiring, as I am sure it is to many others also. I have been day dreaming of doing the exact same thing as you for years….but it is that ultimate leap that is preventing me from doing all that:)

Best of luck,

Fred

Really depends on the volume Fred. Before during the peak volumes of the 2008 crisis and even the end of 2012 probably could have been filled with higher contracts. The volume now is significantly lower so I would suspect that depending on volume you may have issues with a contract load above about 100 or so. But at the end of the day it really all depends on volume.